Capital Flows to Latin America and the Caribbean in five charts: first nine months of 2025

Áreas de trabajo

Tema(s)

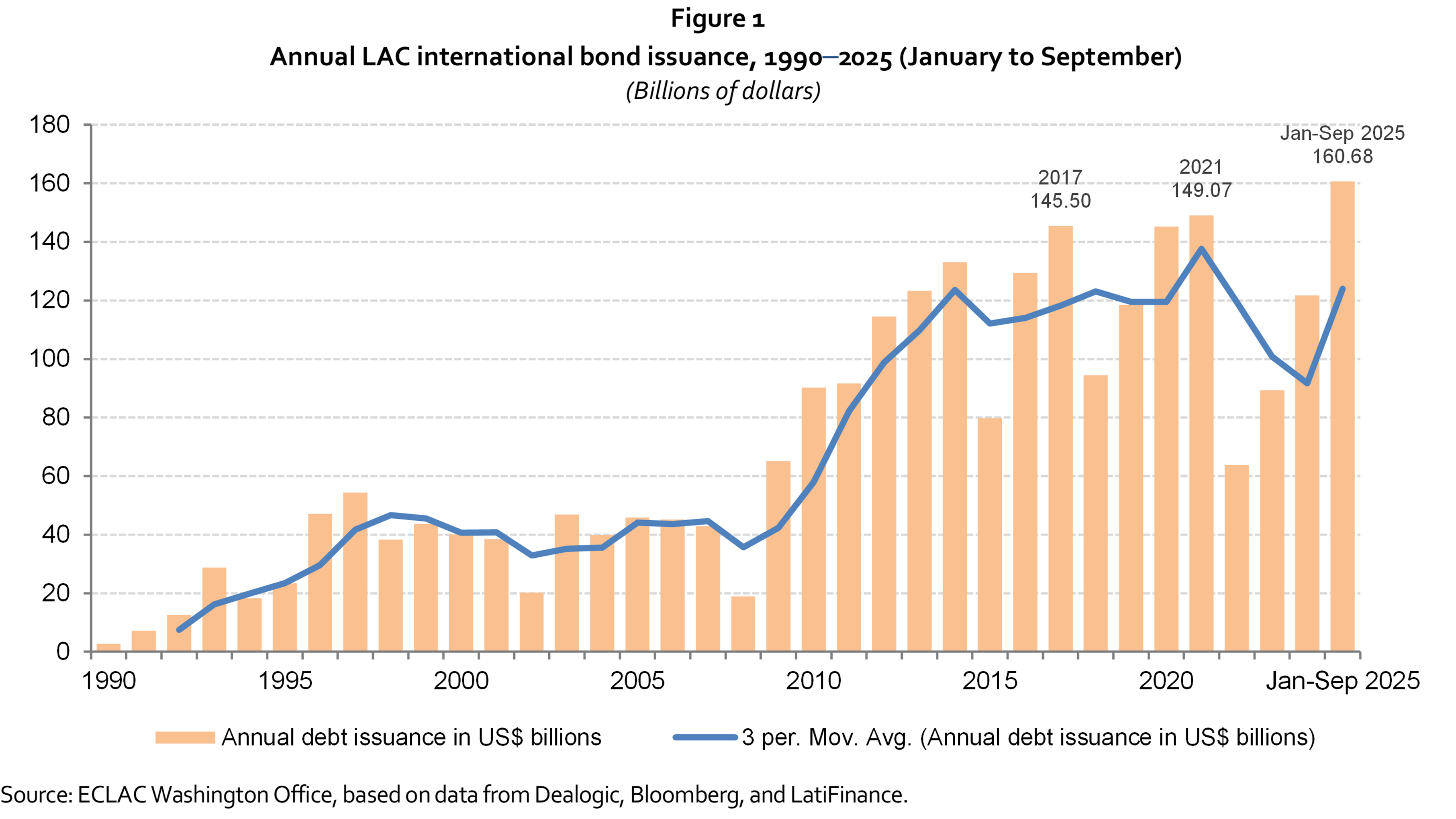

Latin America and the Caribbean set a new annual record for international bond issuance in just nine months of 2025.

- International bond issuances by Latin American and Caribbean issuers reached US$ 161 billion in the first nine months of 2025—the highest annual level on record. This volume was 32% above the full-year total for 2024 (US$ 122 billion) and exceeded the previous peak of 2021 (US$ 149 billion), highlighting the exceptionally strong pace of external financing so far this year (figure 1). The average coupon fell to 6.6% from 7.1% in 2024, indicating lower external borrowing costs.

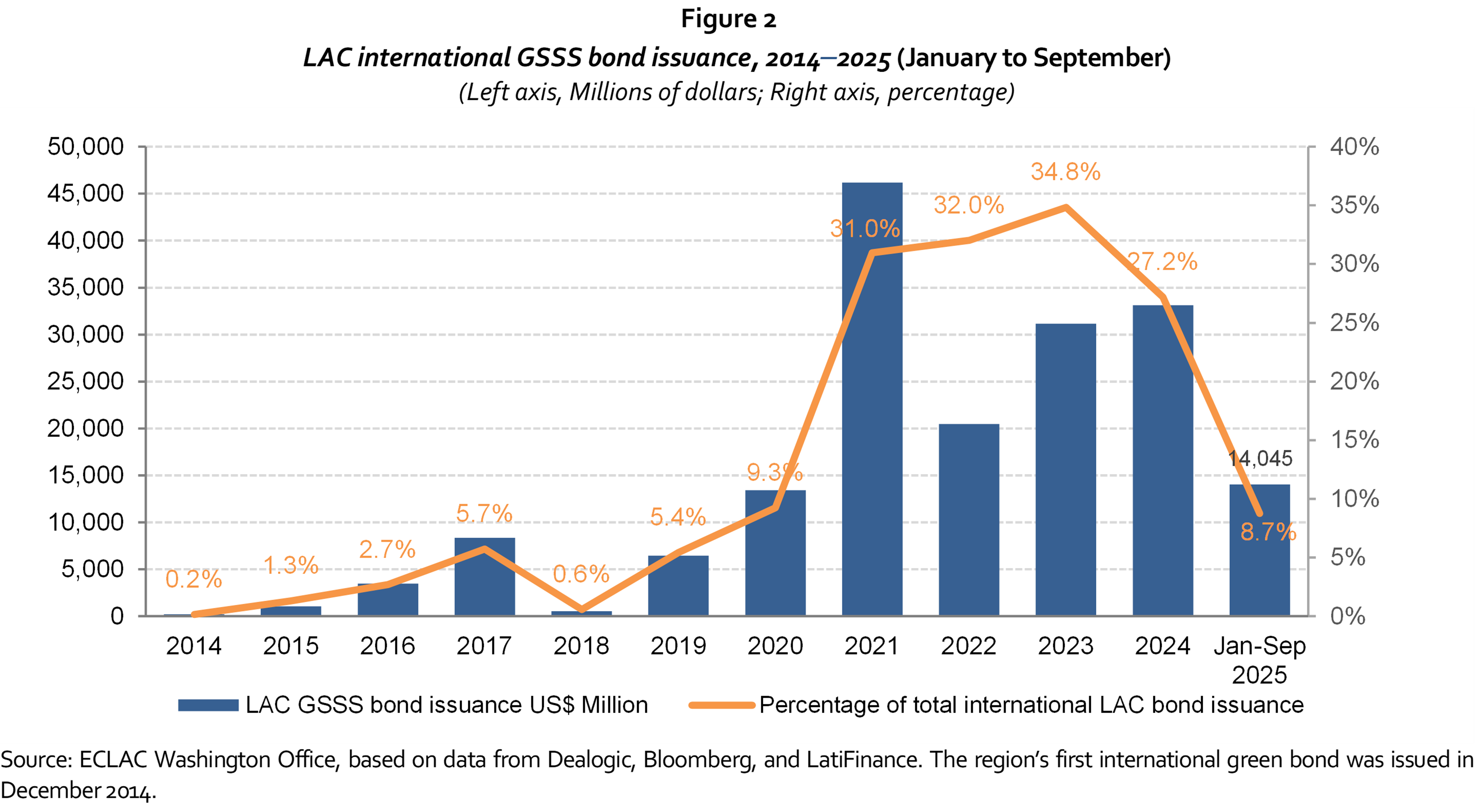

2. While overall issuance reached record levels, issuance of green, social, sustainability and sustainability linked (GSSS) bonds moved in the opposite direction. The region issued US$ 14.05 billion in GSSS bonds in the first nine months of 2025, down 54.5% from the same period in 2024. This total represented an 8.7% share of the region’s total international bond issuance, down from the record 35% annual share in 2023 and 27.2% in 2024 (figure 2).

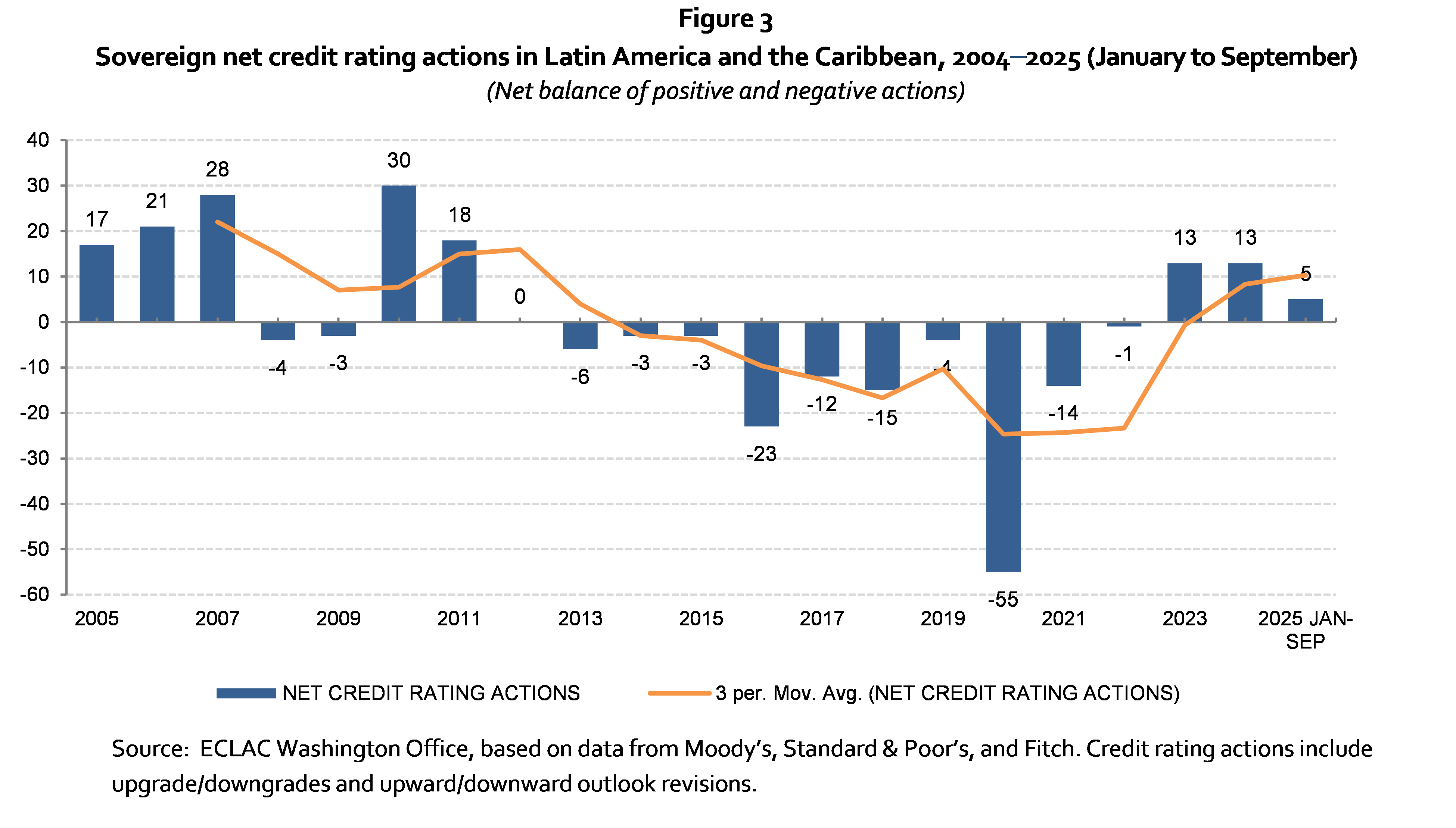

3. Sovereign credit rating actions in the region were a net positive, continuing the positive trend that began in 2023. Overall, 21 rating actions took place during the period, with upgrades and outlook improvements outnumbering downgrades and negative outlook revisions. There were five more positive than negative actions, and four more upgrades than downgrades (figure 3).

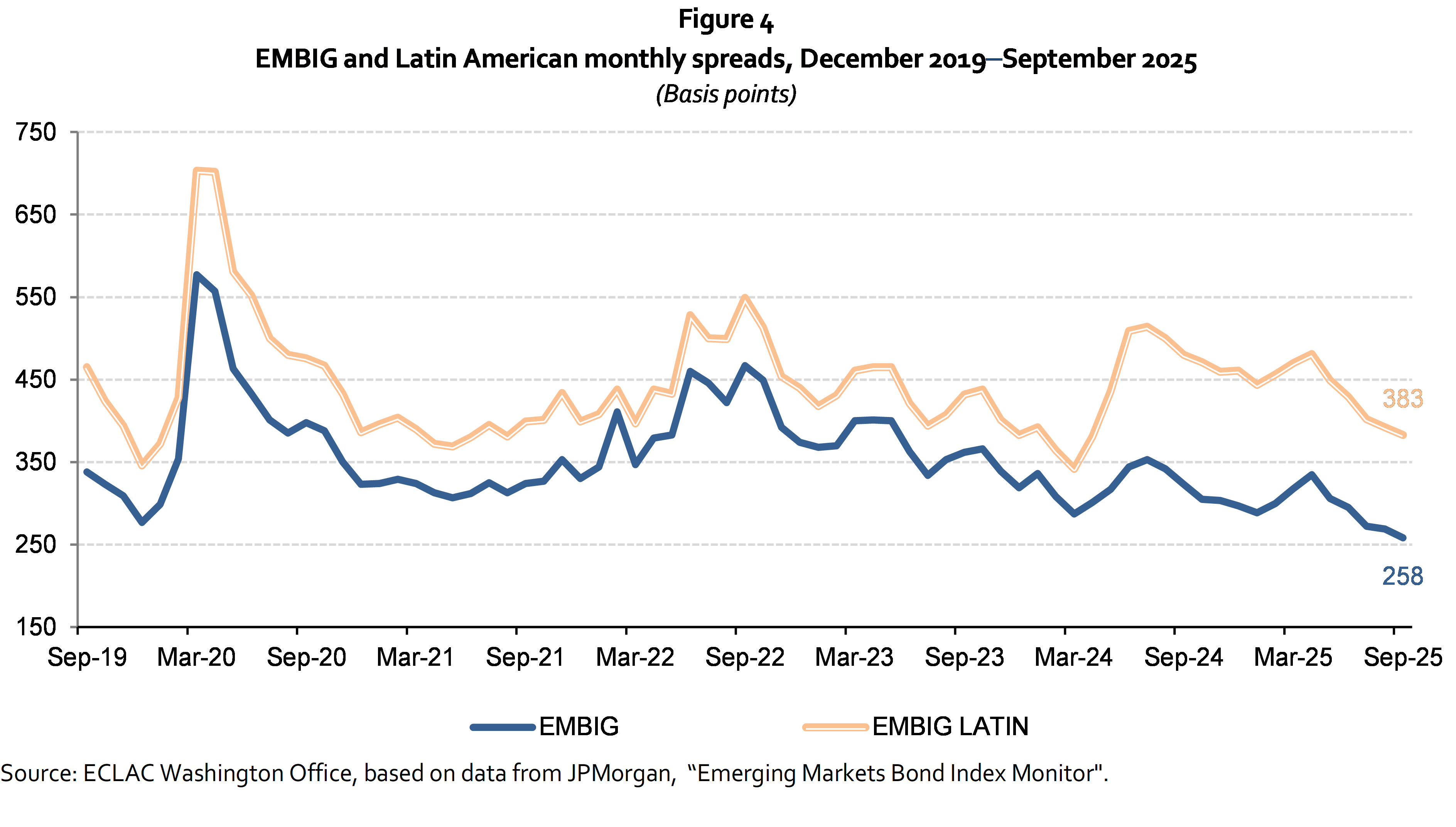

4. Spreads tightened and market volatility remained low. The Latin EMBIG tightened by 78 basis points in the period, while the overall EMBIG narrowed by 39 basis points. Latin American bonds’ greater sensitivity to currency movements partly explains the stronger compression in spreads, as a weaker U.S. dollar and lower Treasury yields supported debt performance. LAC bond spreads stood at 383 basis points at the end of September 2025, while the EMBIG stood at 258 basis points (figure 4).

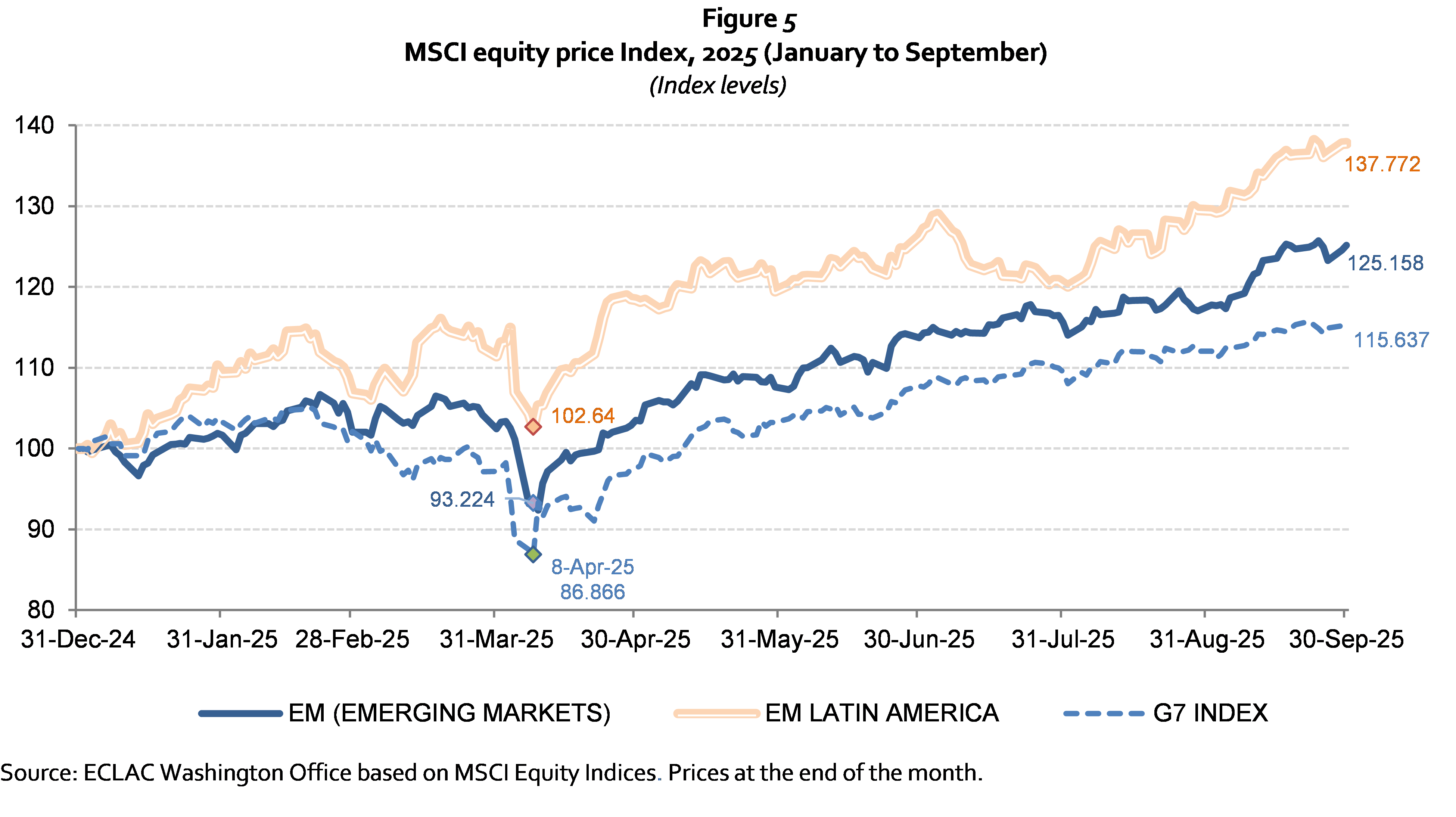

5. Equity markets rebounded strongly. After a low point in early April following U.S. tariff announcements, regional equities rallied as risk appetite recovered and LAC currencies appreciated against the U.S. dollar. The MSCI Latin America Index rose by 38% in the first nine months of 2025, outperforming both the MSCI Emerging Markets (25%) and MSCI G7 (16%) indices.

Together, these developments highlight a year of record market activity, improved credit sentiment, and stronger risk appetite toward Latin American assets, setting a constructive tone for the remainder of 2025.

For a complete and detailed analysis see the PDF attachment with the full document.

Capital flows to Latin America and the Caribbean: first nine months of 2025 | CEPAL