United States economic outlook: third quarter of 2024 in five charts

Áreas de trabajo

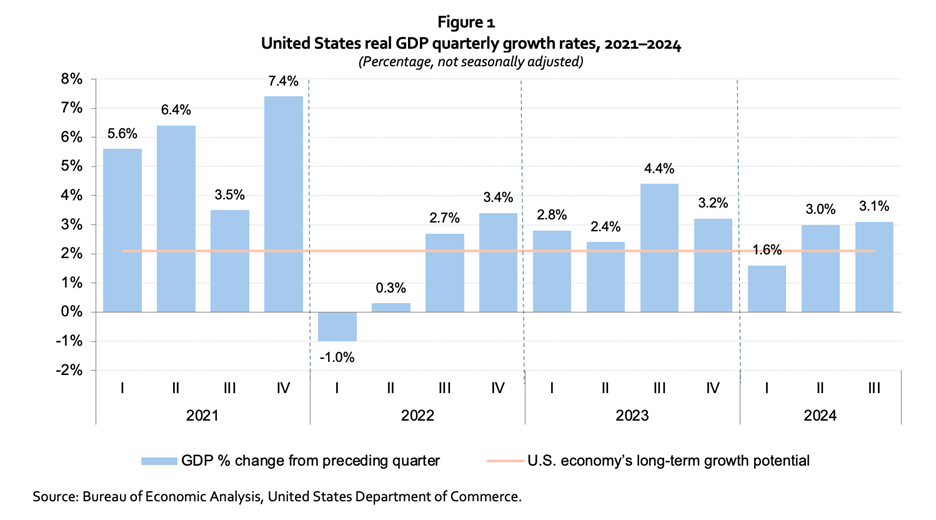

The U.S. economy expanded at a robust 3.1% annualized rate in the third quarter of 2024, well above the economy’s long-term growth potential.

United States economic outlook: third quarter of 2024 in five charts

The U.S. economy expanded at a robust 3.1% annualized rate in the third quarter of 2024, well above the economy’s long-term growth potential.

- The United States economy expanded at an annualized rate of 3.1% in the third quarter of 2024, above the economy’s long-term growth potential and the 3.0% growth in the second quarter, driven primarily by consumer spending (figure 1).

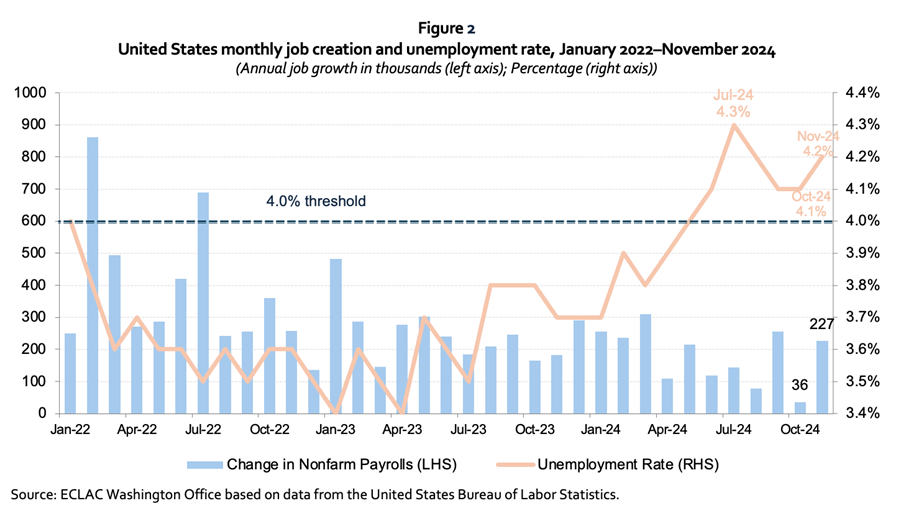

- Employment has increased for 47 consecutive months, but the labor market is softening. Overall, 1.98 million new jobs were added from January to November 2024, 27% less than in the same period in 2023 (2.72 million). The unemployment rate was at 4.2% in November 2024. For more than two years the unemployment rate remained below 4% but crossed above this threshold in June 2024 for the first time since 2021 (figure 2)

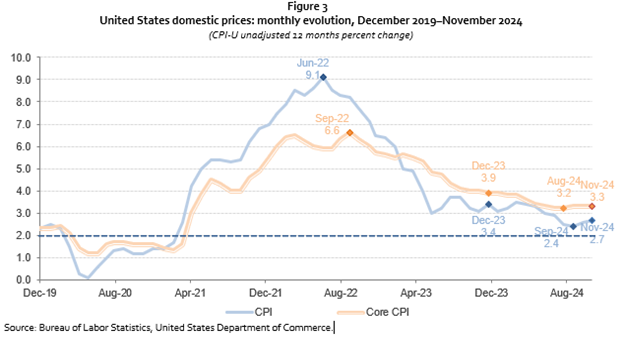

- Progress in bringing down inflation has stalled, with the CPI ticking up to 2.7% in November from 2.4% in Septembe 2024, which had been the lowest level in more than three years. Core CPI was at 3.3% in November, slightly up from 3.2% in August, but unchanged since September (figure 3).

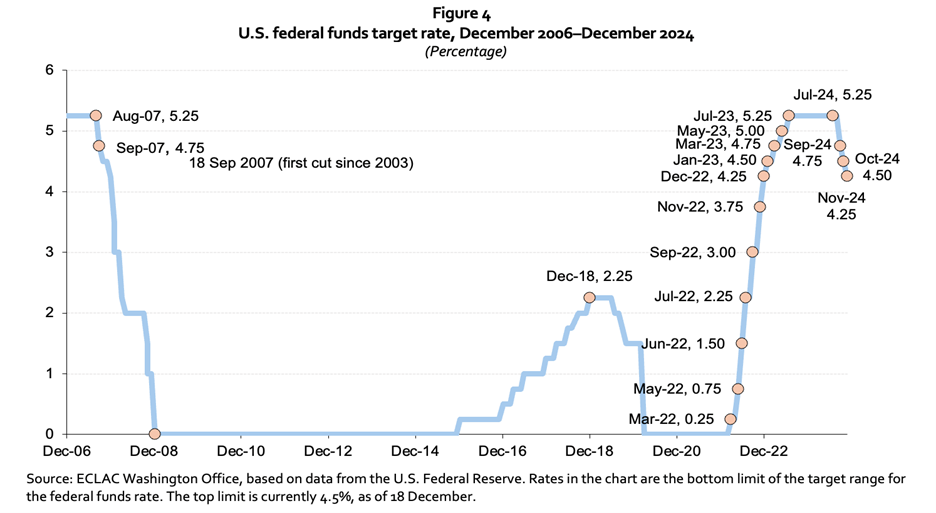

- The Fed cut interest rates for a third and final time in 2024 at its December meeting, lowering the federal funds rate by 0.25% to a range of 4.25% to 4.50% (figure 4), and signaling a slower pace of easing in 2025. Having lowered rates by a full percentage point from September to December 2024, Fed officials anticipate just two more interest rate cuts in 2025.

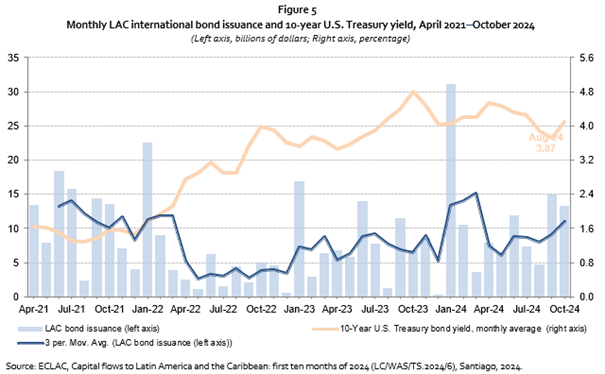

- Since U.S. interest rates reached a peak in July 2023, some of the pressure on Latin America and the Caribbean (LAC) financial conditions have eased, with LAC dollar-denominated debt issuances in international markets increasing 8% to US$ 32.94 billion in the first ten months of 2024 from US$ 30.38 billion in 2023. The Fed has embarked on a new easing cycle that should help to further ease financial pressures in the region, but the election results point to a shift in U.S. economic policy. Pledges of higher tariffs and lower taxes could strengthen the U.S. dollar and push government borrowing higher, leading to higher U.S. Treasury yields and curbing investors' appetite for emerging markets and LAC assets (figure 5).

For a complete and detailed analysis see the PDF attachment with the full document. This report contains a special chapter on the performance of the United States economy during the past three U.S. administrations and the role the state of the economy may have played in the 2024 presidential election.

Link to the document:

https://www.cepal.org/en/publications/81191-united-states-economic-outlook-third-quarter-2024

Contenido relacionado

Sede(s) subregional(es) y oficina(s)

País(es)

-

United States