Capital Flows to Latin America and the Caribbean in five charts: first ten months of 2024

Áreas de trabajo

Latin America and the Caribbean's international bond issuances continue to rebound from the 2022 low levels.

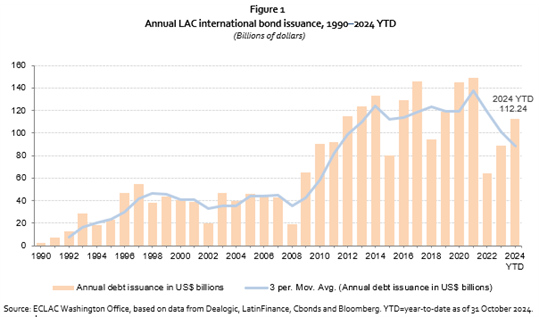

1. Latin American and Caribbean (LAC) issuers placed US$ 112 billion of bonds in international markets in the first ten months of 2024. This total was 40% higher than in the same period in 2023. Volumes increased as the global monetary policy tightening cycle reached a peak and in anticipation of monetary easing, particularly in the United States, which has cut interest rates three times in 2024 (figure 1).

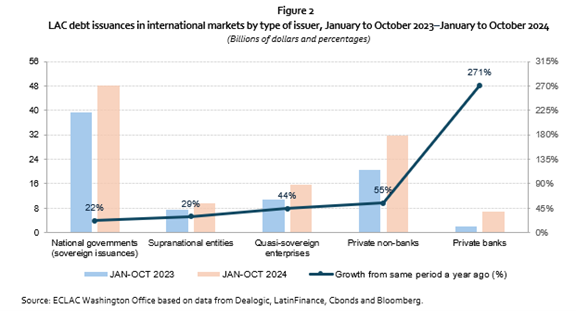

2.Corporate sector participation rebounded in the first ten months of 2024, following two consecutive years in which the region’s sovereign debt issuances surpassed the 50%-mark. Corporate bond issuances (including private bank and non-bank, state-owned enterprises, and supranational entities) represented 57% of the total, with private bank and non-bank debt issuances showing the largest increases (figure 2).

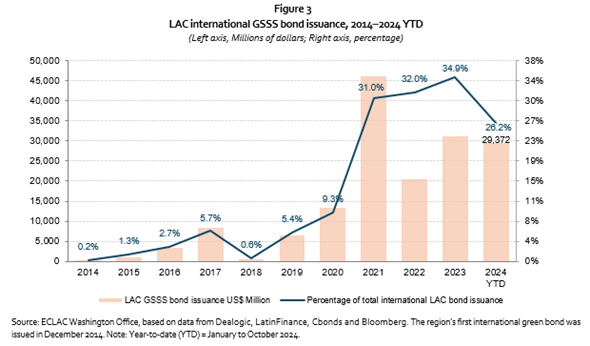

3. The region issued US$ 29 billion in international green, social, sustainability and sustainability-linked (GSSS) bonds, up 19% from the same period in 2023. This total represented a 26% share of the region’s total international bond issuance, down from 31% in the same period in 2023 and from the record 35% annual share in 2023 (figure 3).

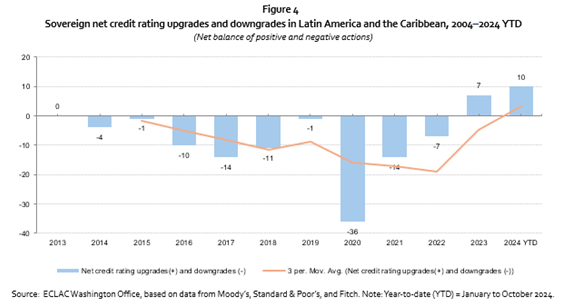

- Sovereign credit rating actions in the region over the first ten months of 2024 were a net positive. Overall, 28 actions took place, with a balance of 10 more positive credit rating actions than negative. Upgrades outpaced downgrades. There were ten more upgrades than downgrades, an improvement on last year’s annual balance of seven (figure 4).

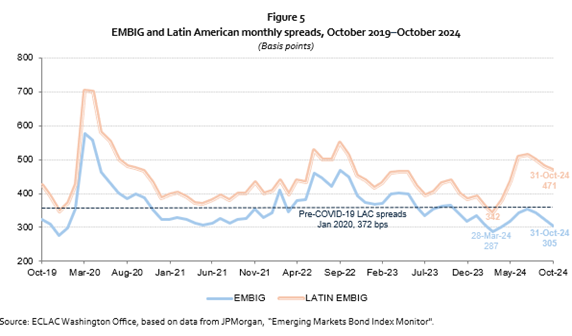

5. Borrowing costs for LAC issuers as measured by the JPMorgan Emerging Markets Bond Index Global (EMBIG) widened by eighty-eight basis points in the first ten months of 2024, while the overall EMBIG tightened by fourteen. Latin American bonds’ sensitiveness to currency volatility may explain why the Latin EMBIG experienced widening spreads while the overall EMBIG did not. LAC bond spreads stood at 471 basis points at the end of October 2024, while the EMBIG stood at 305 basis points (figure 5).

For a complete and detailed analysis see the PDF attachment with the full document.

Capital flows to Latin America and the Caribbean: first 10 months of 2024 | CEPAL

Contenido relacionado

Sede(s) subregional(es) y oficina(s)

País(es)

-

United States