Capital Flows to Latin America and the Caribbean: the first eight months of 2022 in five charts

After breaking an annual record in 2021, total Latin American and Caribbean (LAC) bond issuance in international markets slowed considerably in the first eight months of 2022.

-

Against a backdrop of tightening global financing conditions, total Latin American and Caribbean (LAC) bond issuance in international markets fell by more than half in the first eight months of 2022 compared to the same period in 2021.

-

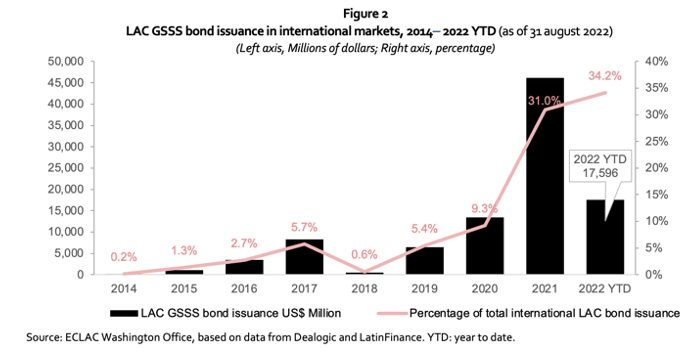

LAC issuance of green, social, sustainability and sustainability-linked bonds also slowed down in the first eight months of 2022, but less than total overall issuance. Their share in the region’s total overall issuance increased to 34% from 31% in 2021.

-

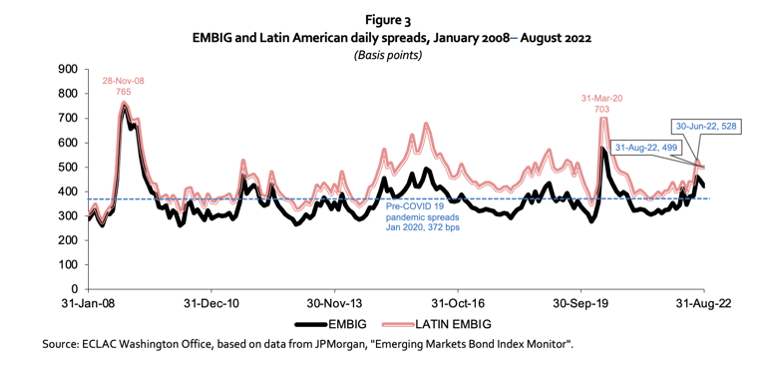

Borrowing costs for LAC issuers increased by 100 basis points in the first eight months of 2022, amid rising financing costs and weaker risk sentiment, and reached a peak in June 2022. At 499 basis points at the end of August, LAC bond spreads were 127 basis points higher than pre-pandemic levels.

-

In the first eight months of 2022, the MSCI Latin American index lost 0.2%, but it outperformed the emerging markets and the G7 indices. Latin American equity prices have lost some of the ground they had gained earlier in the year. According to the index, Latin American stock prices were down 24% in the second quarter, after gaining 26% in the first.

-

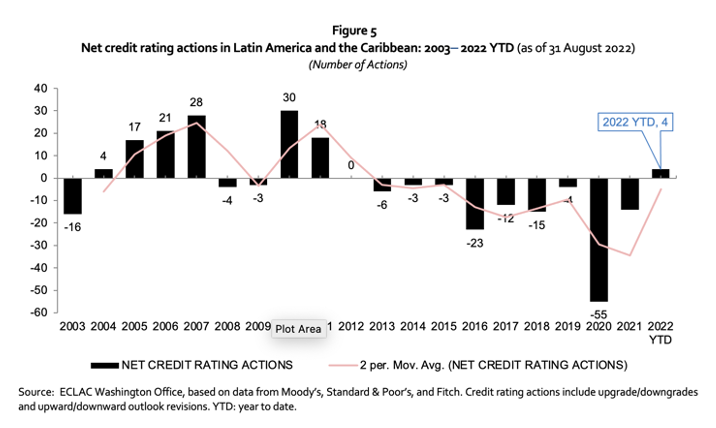

The region’s credit outlook has trended upwards in 2022 so far, supported by lower funding needs and greater reliance on local markets. As of 31 August 2022, there were four more positive credit rating actions than negative since the beginning of the year.

For a complete and detailed analysis see the PDF attachment with the full document.

Sede(s) subregional(es) y oficina(s)

País(es)

- Latin America and the Caribbean