Sustainable Bonds in Latin America and the Caribbean: A Decade of Growth (2014–2024)

Topic(s)

Since the region’s first green bond in 2014, issuers have raised more than US$164 billion in international markets. These funds have helped drive renewable energy, sustainable farming and forestry, social programs, and other projects that support sustainable development. This trajectory mirrors global trends and shows the region’s role in the expansion of sustainable finance. At the same time, it raises key questions: how has this financing been distributed across sectors, and to what extent is it supporting the energy transition?

Sustainable bonds by sector: Financing the 2030 Agenda and energy transition

The report Mapping sustainability in Latin America and the Caribbean: sectoral and energy transition insights from sustainable bonds, 2014–2024 examines sectoral issuance patterns using a dedicated dataset developed by the ECLAC Washington Office in the framework of its Capital Flows to Latin America and the Caribbean reports.

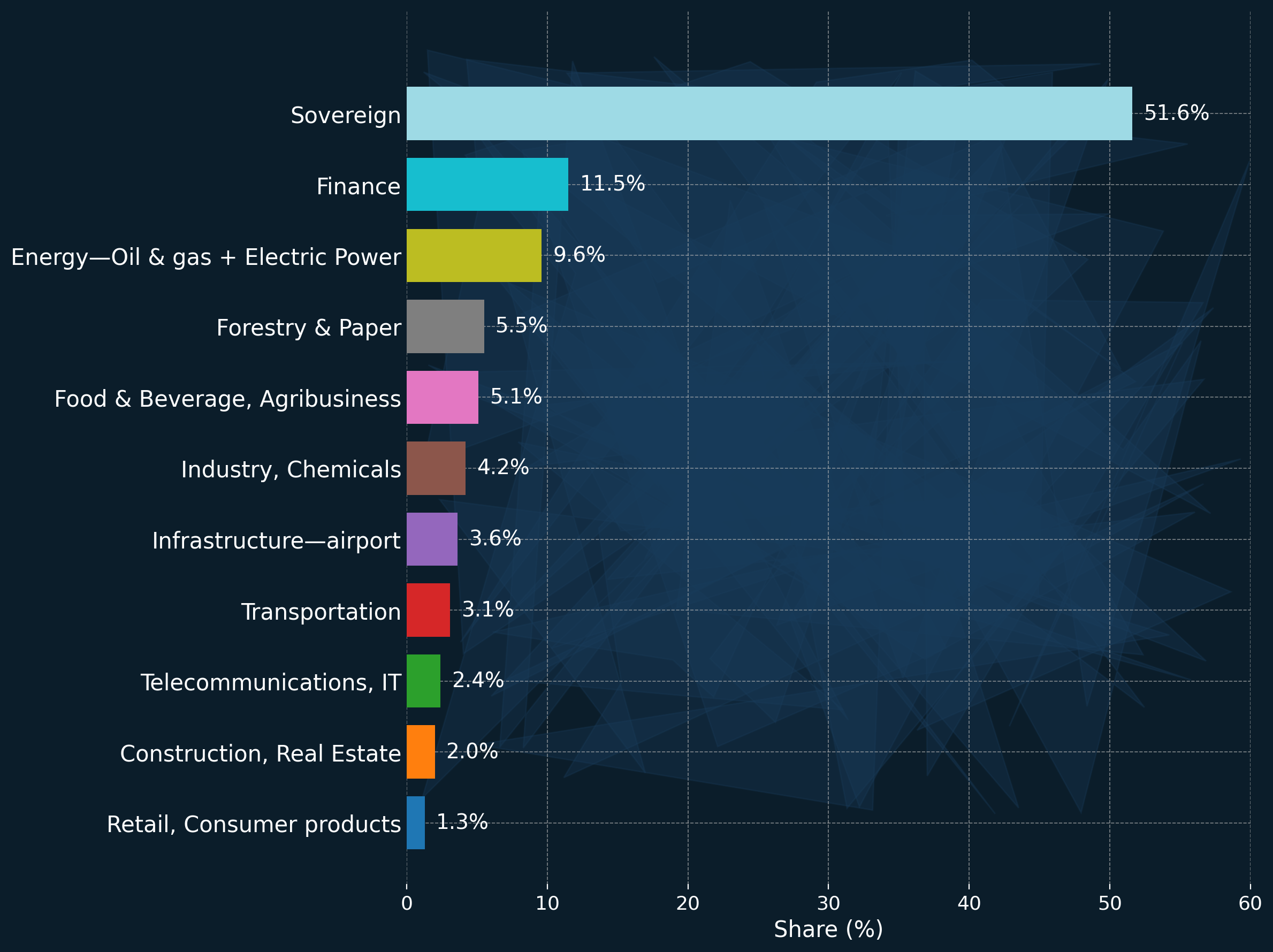

Between 2014 and 2024, 106 regional issuers placed 278 GSSS bonds in 16 currencies. The sovereign sector dominated with 52% of the total, largely driven by Chile’s issuances since 2019. Beyond sovereigns, the leading sectors were finance (11.5%), energy (9.6%), forestry and paper (5.5%), food and beverage, agribusiness (5.1%), and industry, chemicals (5.1%). Together with sovereigns, these sectors accounted for nearly 88% of total issuance in the ten-year period (figure 1).

How has sustainable bond issuance been distributed across sectors?

[Figure 1] Source: Velloso and Perrotti (2023), figure 17, p. 30. Updated by authors to December 2024.

This distribution underscores the dual role of GSSS bonds: sovereign issuances have created fiscal space for social and environmental spending, while corporate and sectoral issuances are increasingly financing productive transformations needed to advance the 2030 Agenda for Sustainable Development and the energy transition.

Empirical evidence: How sustainable bonds affect energy transitions in Latin America

The study also conducts an empirical exercise to test whether GSSS bonds have contributed to observable outcomes in the energy sector. Using a panel robust fixed-effects model for the top five issuers—Brazil, Chile, Colombia, Mexico, and Peru—the analysis examines the relationship between international GSSS issuance to energy and two transition indicators: renewable capacity per capita and the share of renewables in primary energy consumption.

Results show a positive and statistically significant link between GSSS issuance and renewable capacity per capita, confirming that sustainable bonds have helped expand renewable infrastructure. However, no significant effect was found on the share of renewables in total energy consumption. In other words, while financing has added projects, it has not yet produced a structural change in the energy mix.

Unlocking the potential: policy pathways for the road ahead

These findings point to the need for complementary measures. Three priorities stand out:

- Energy market design: mechanisms such as priority dispatch, storage, and grid integration are essential to raise renewables’ share in the mix.

- Domestic value chains: linking GSSS-financed projects to local industry and technology can enhance employment and innovation.

- Transparency and accountability: the credibility of the market depends on clear reporting of financial allocations and environmental results.

Development banks also have a catalytic role, through guarantees, blended finance, and local currency instruments that reduce risks and mobilize private capital. At the same time, Green Productive Development Policies (GPDPs) can embed environmental objectives into productive strategies, aligning GSSS financing with structural transformation.

The study concludes that GSSS bonds have contributed to expanding renewable capacity in LAC but have not yet shifted the regional energy mix. Closing this gap requires aligning sustainable finance with market reforms, productive development, and accountability. International experiences—from dynamic pricing schemes to green hydrogen projects—offer lessons that LAC countries can adapt to their contexts. By combining innovative financing with enabling policies, the region can transform initial advances into systemic progress on the energy transition and sustainable development.

Related content

Subregional headquarter(s) and office(s)

Country(ies)

- Latin America and the Caribbean

Related link(s)

-

Helvia Velloso, Daniel E. Perrotti and Rudá Sobreira (2025), “Mapping sustainability in Latin America and the Caribbean: sectoral and energy transition insights from sustainable bonds, 2014–2024”

Helvia Velloso and Daniel E. Perrotti (2023), “Sustainable bond issuances in international markets, 2014–2022: characteristics, trends and greenium in Latin America and the Caribbean”, Studies and Perspectives series-ECLAC Office in Washington, D.C.

Ignacio Martínez, Andrés Valenciano, Helvia Velloso, and Daniel E. Perrotti (2025), "Unleashing sustainable growth: financing green productive development policies in Latin America and the Caribbean"