U.S. Economic Outlook - First Quarter of 2019

Work area(s)

Topic(s)

In the first quarter of 2019 the U.S. economy grew at an above-trend annualized rate of 3.1%

In the first quarter of 2019 the U.S. economy grew at an above-trend annualized rate of 3.1%.

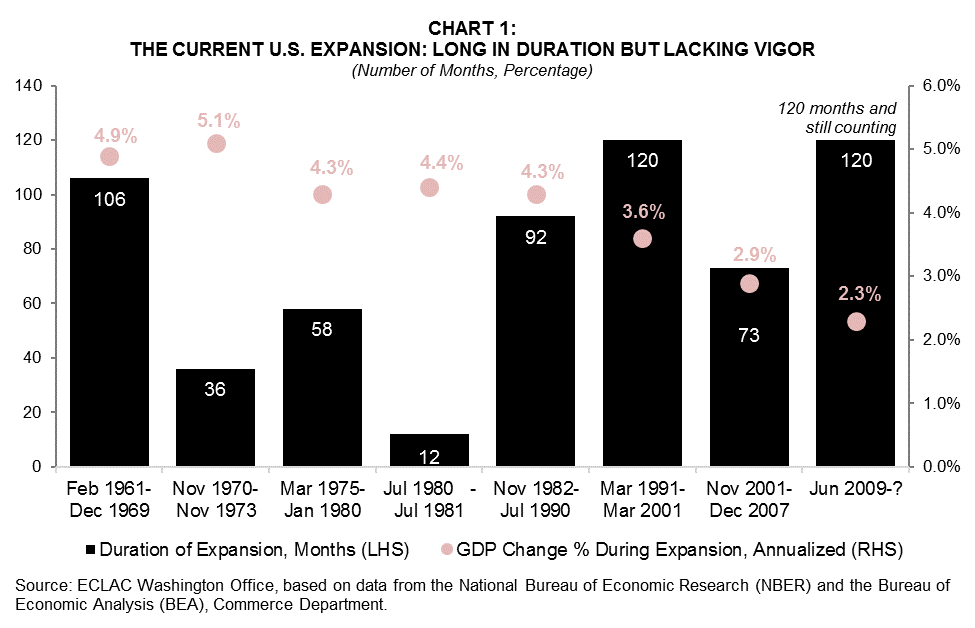

June marked the 10th anniversary since the end of the last recession. In July, the current expansion became the longest on record. However, growth has been shallower than in previous expansions (chart 1).

The U.S. economy grew at an above-trend annualized rate of 3.1% in the first quarter of 2019, despite the government shutdown and concerns about residual seasonality. Growth was driven by exports and a buildup in inventories. This was the fastest first-quarter growth since 2015 (chart 2)

In May, U.S. employers added just 75,000 jobs, one of the smaller gains since the recession ended in mid-2009 (chart 3). The unemployment rate held steady at 3.6%, its lowest level since 1969, as did the participation rate at 62.8%.

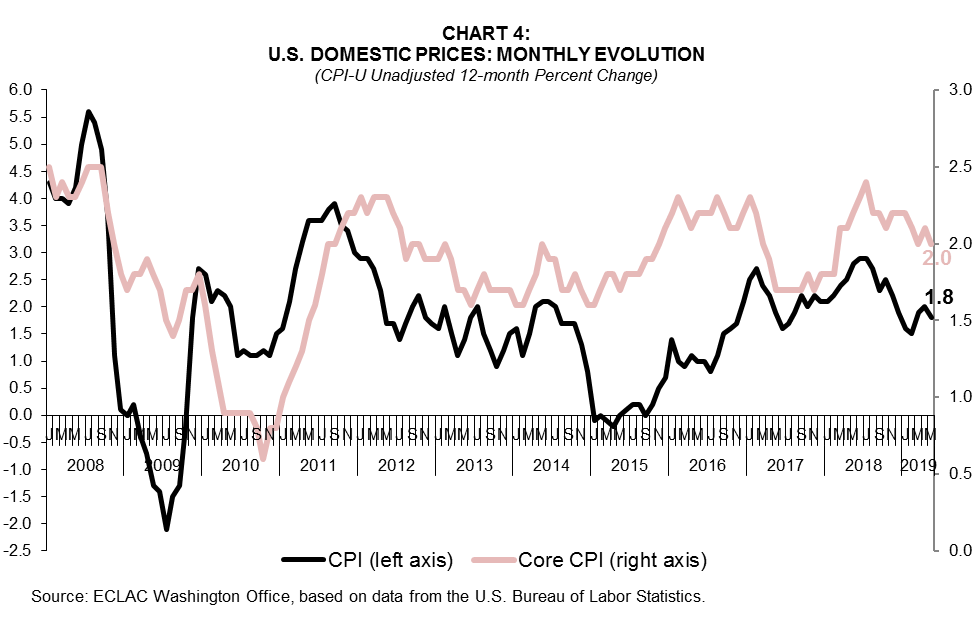

U.S. consumer price inflation moderated in May, suggesting inflationary pressures remain muted. Over the last 12 months, the all items Consumer Price Index (CPI) rose 1.8%. The core CPI was up 2.0%. Core inflation has fallen from its recent high of 2.4% in July 2018, despite the strong labor market delivering wage gains for workers (chart 4).

The U.S. current account deficit fell to US$ 130 billion in the first quarter of 2019 (2.5% of GDP), from US$ 144 billion in the fourth quarter. Despite the decline, the current account deficit in the first quarter of 2019 is the second largest of the past decade (chart 5).

In June, the Federal Open Market Committee (FOMC) kept the target range for the fed funds rate steady but indicated in its statement that it could soon cut it to help sustain the economic expansion (chart 6).