United States economic outlook: third quarter of 2021

Work area(s)

Economic growth in the United States slowed to a 2.1% annual rate in the third quarter of 2021, from a 6.7% annual rate in the second.

Economic growth in the United States slowed to a 2.1% annual rate in the third quarter of 2021, from a 6.7% annual rate in the second.

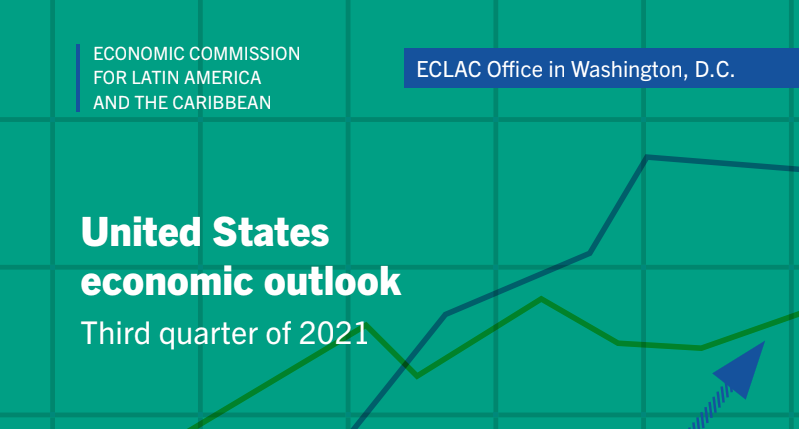

1. Economic growth in the United States slowed to a 2.1% annual rate in the third quarter of 2021, from a 6.7% annual rate in the second. Consumer spending rose at its slowest pace since the recovery began, as durable goods spending fell sharply (chart 1). Multiple factors contributed to the slowdown in growth, including fading federal stimulus spending, a new wave of COVID-19 infections caused by the Delta variant, and supply shortages, which contributed to rising prices.

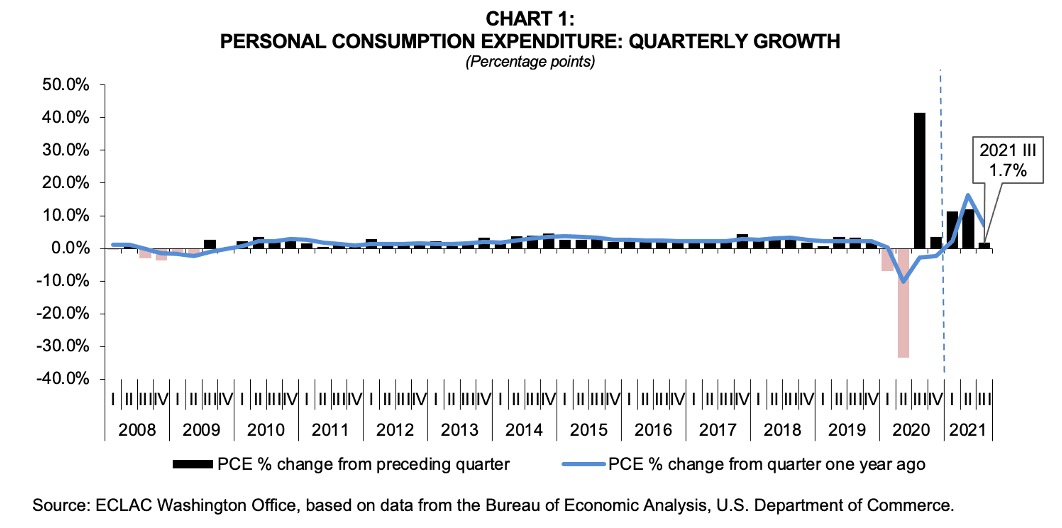

2. Inflationary pressures increased in the third quarter, as well as in October and November. The Consumer Price Index (CPI) rose 6.8% in November from the same month a year ago, the sixth straight month in which inflation topped 5%, and the fastest pace since 1982. The CPI is being boosted by a rise in energy prices and by supply-chain disruptions, as well as by strong demand (chart 2).

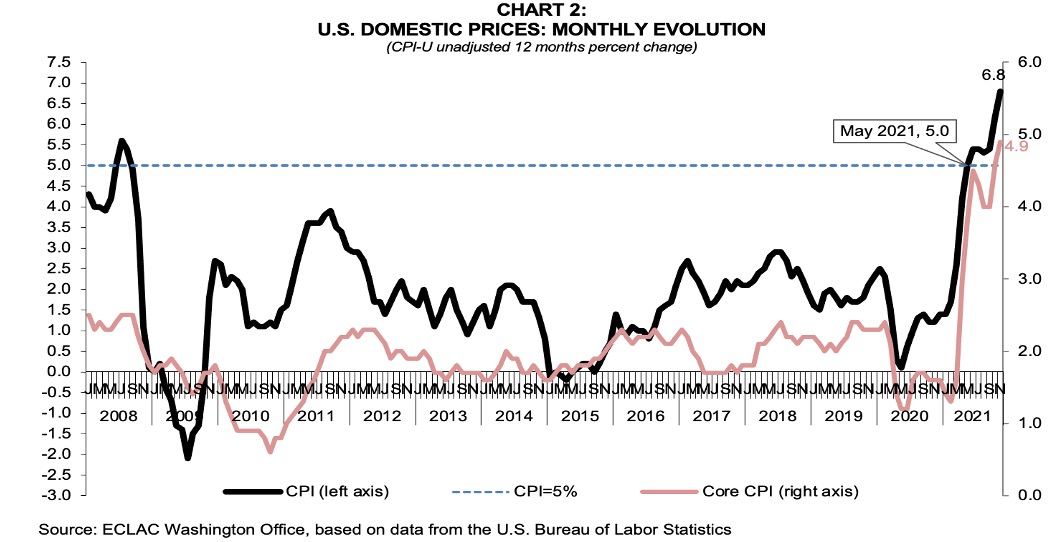

3. Demand is booming, supported by a buoyant job market and robust household savings. A shortage of available workers during the third quarter led to higher labor costs and pushed companies to raise prices to offset them. First-time claims for unemployment benefits, a proxy for layoffs, fell to 184,000 in the week ended on 4 December, its lowest level since September 1969, just 18 months after the pandemic prompted six million workers to file for unemployment in one week (chart 3).

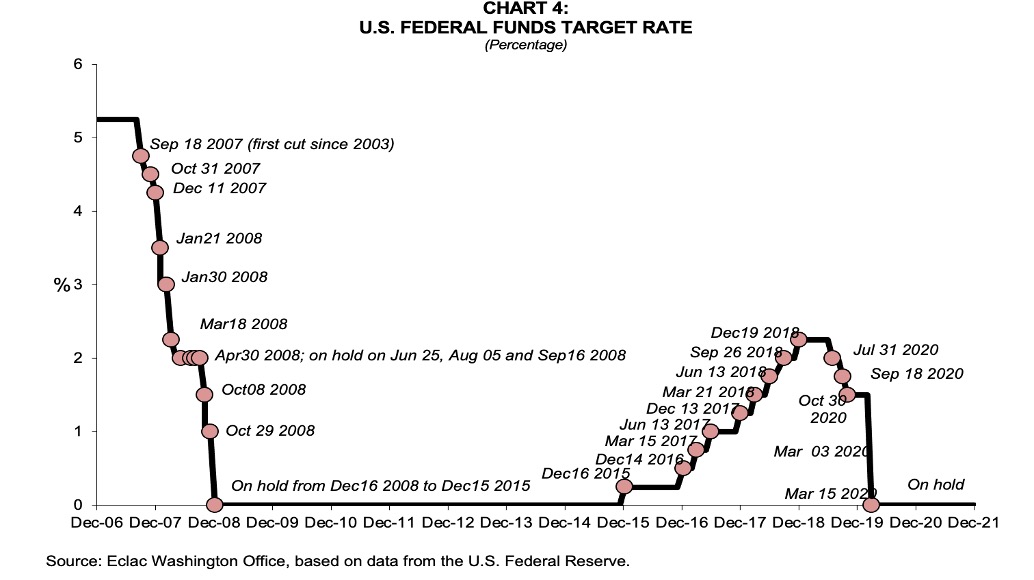

4. The monetary policy stance has shifted towards removing policy accommodation at a faster pace. After its December 2021 meeting, the Fed kept interest rates on hold (chart 4), dropped language describing inflation as largely transitory, and announced it was doubling the speed of tapering. New projections showed that most officials expect three increases in interest rates in 2022. Latin America and the Caribbean may experience tighter external financial conditions next year as a result.

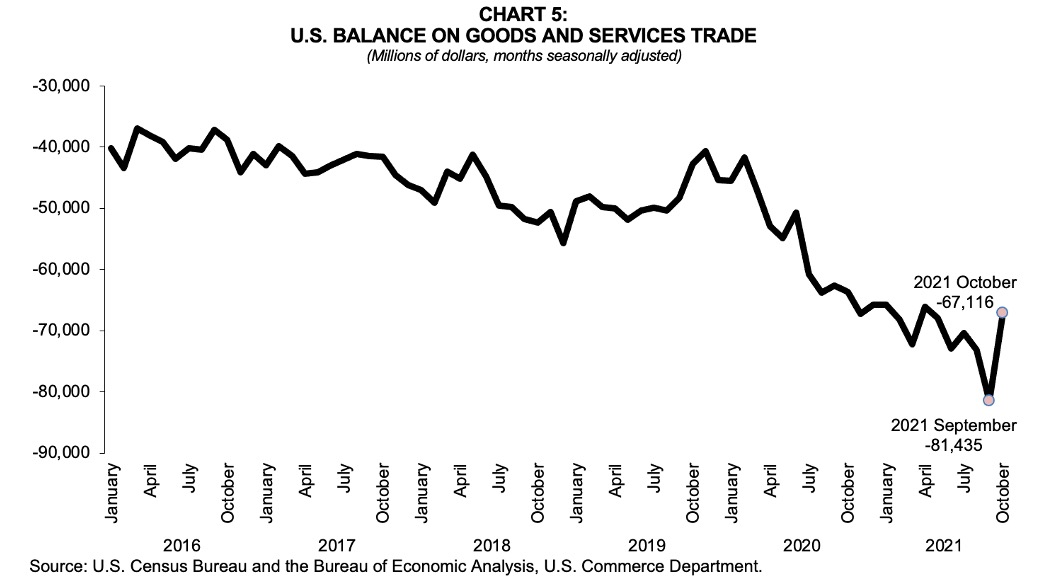

5. The United States nominal trade deficit narrowed noticeably in October, the latest data available, as an increase in exports of energy and agricultural commodities outpaced growth in imports, which were restrained by a backlog at U.S. ports that month. The deficit in trade in goods and services fell by 17.6% to a seasonally adjusted US$ 67.1 billion in October, compared with a record US$ 81.4 billion gap in September (chart 5). This is a positive development for growth in the fourth quarter.

6. The COVID-19 pandemic continues to be a major risk to the outlook, with the emergence of the Omicron variant and the continued spread of Delta threatening the economic expansion.

For a complete and detailed analysis see the PDF attachment with the full document.

Related content

Subregional headquarter(s) and office(s)

Country(ies)

-

United States