United States economic outlook: first half of 2024 in five charts

Work area(s)

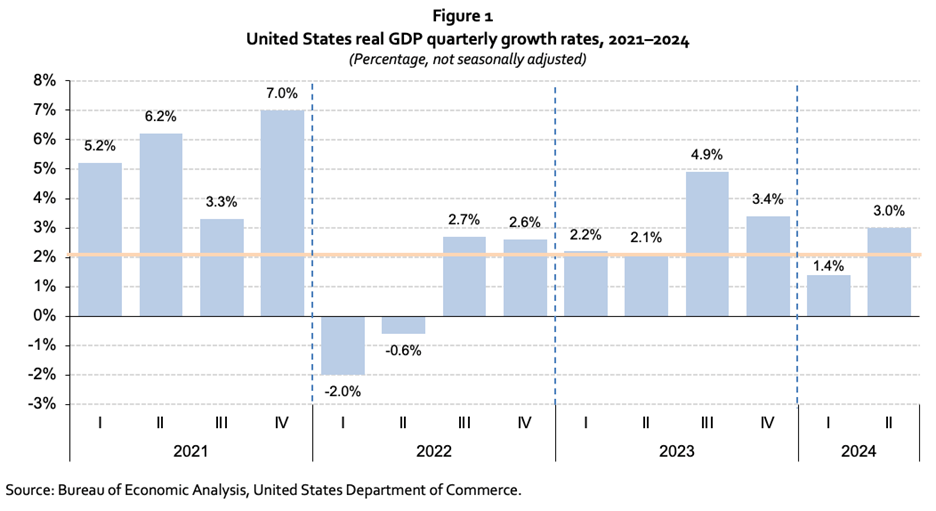

The U.S. economy expanded at a robust 3.0% annualized rate in the second quarter of 2024, more than double the 1.4% increase in the first quarter and well above the economy’s long-term growth potential.

1. The United States Gross Domestic Product (GDP) rose 3.0% in the second quarter, above the economy’s long-term growth potential and the 1.4% growth in the first quarter (figure 1). Consumer spending was the main driver of the GDP increase in the first and second quarters.

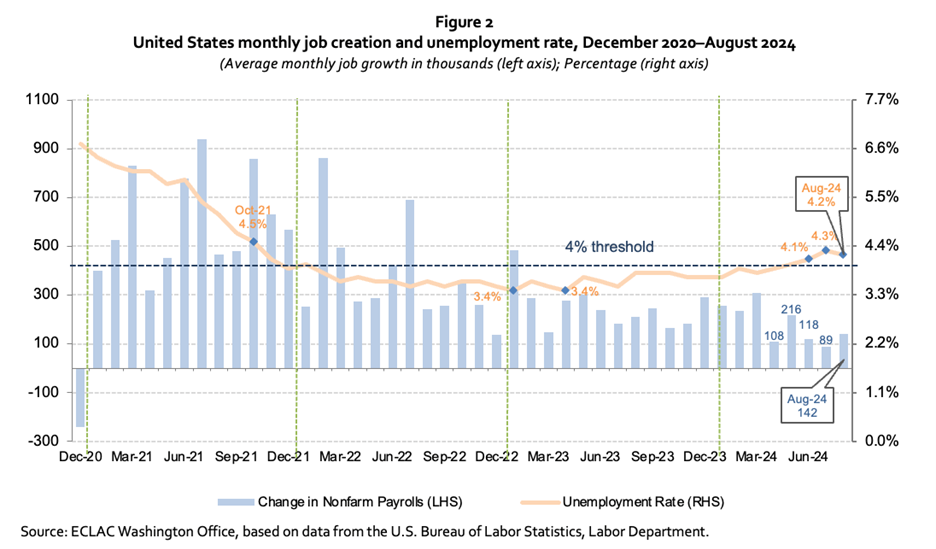

2. Employment has increased for 44 consecutive months, but the labor market is softening. An average of 184,000 new jobs were created per month and 1.48 million new jobs were added from January to August 2024, less than in the same period in 2023. The unemployment rate was at 4.2% in August 2024. For more than two years the unemployment rate remained below 4% but crossed above this threshold in June 2024 for the first time since 2021 (figure 2).

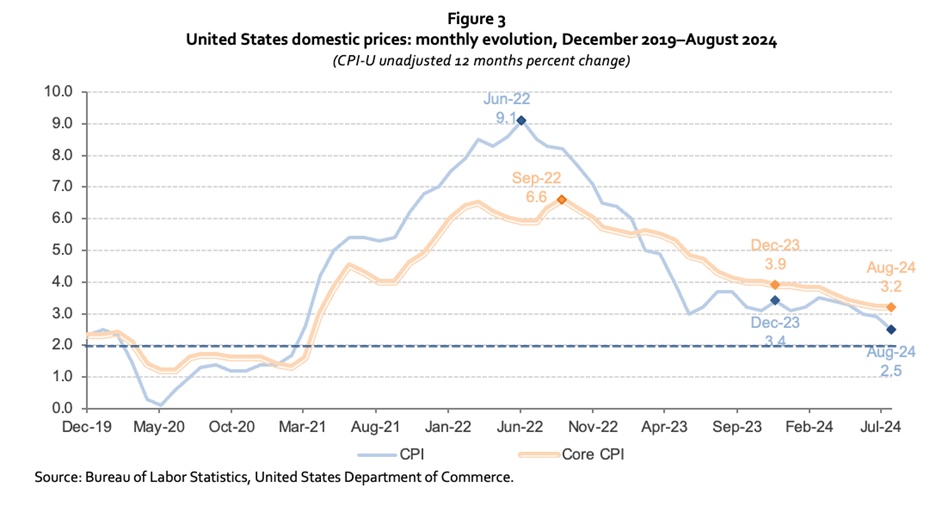

3. Inflation has continued its descent. The Consumer Price Index (CPI) slowed to 2.5% in August 2024, the lowest level in more than three years, from 3.4% in December 2023 and a peak of 9.1% in June 2022. Core CPI, which excludes the volatile energy and food categories, was at 3.2% in August 2024, slowing from 3.9% in December 2023 and a peak of 6.6% in September 2022 (figure 3).

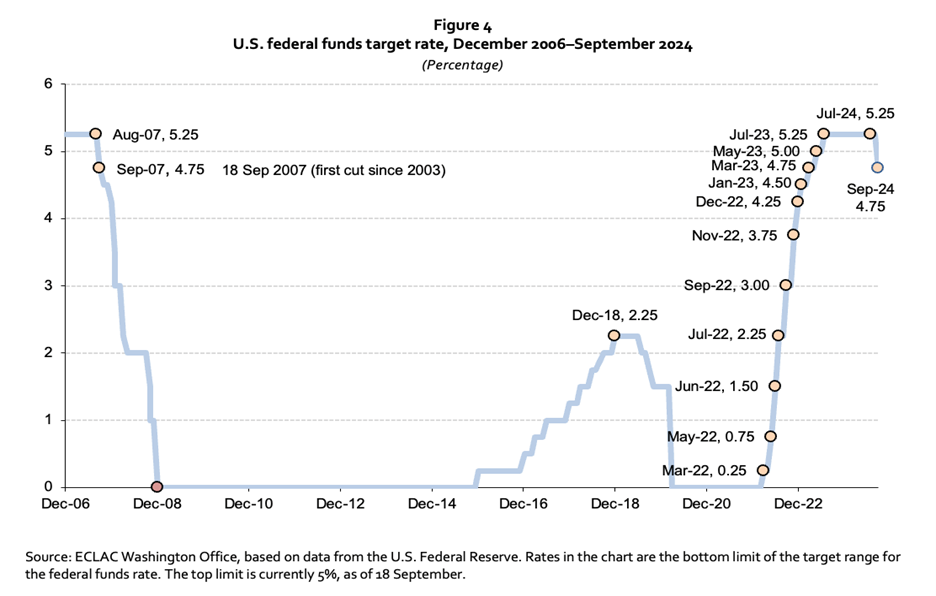

4. The Federal Reserve has started a new monetary easing cycle, announcing an interest rate cut of 0.50% —the first cut since the Covid-19 pandemic began— at its September rate-setting meeting, leaving the federal funds rate at a range of 4.75% to 5% (figure 4).

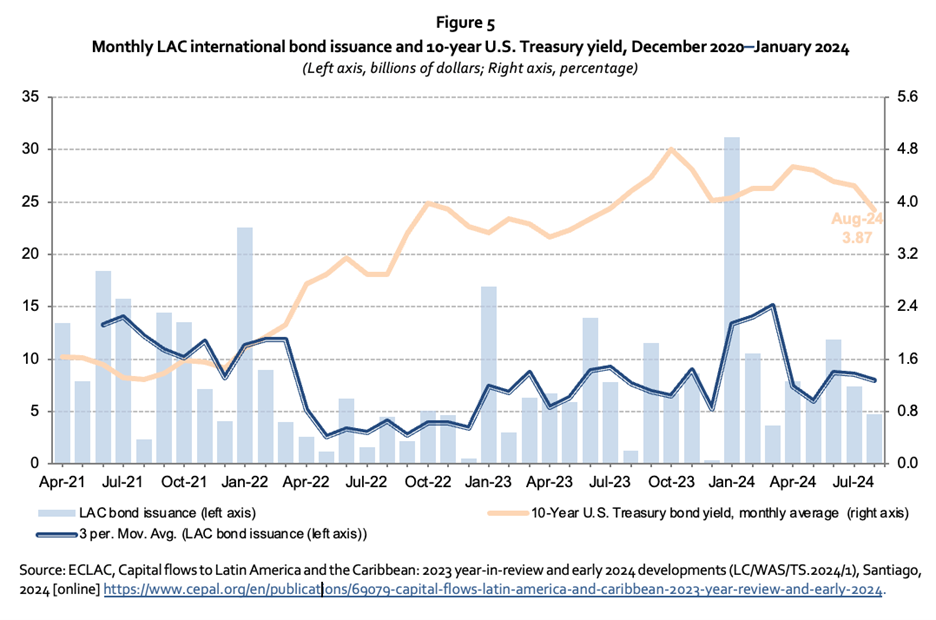

5. Since U.S. interest rates reached a peak in July 2023, some of the pressure on Latin America and the Caribbean (LAC) financial conditions have eased. The Fed is embarking on a new easing cycle that should help to further ease financial pressures in the region. Also contributing, the U.S. 10 year Treasury yield dropped below 4% for the first time since 2024’s opening week in August 2024, lowering the region’s borrowing costs in international capital markets (figure 5). Reflecting financial conditions that are gradually easing, LAC international total debt issuance was $94 billion from January to mid-September 2024, 30% higher than in the same period last year.

For a complete and detailed analysis see the PDF attachment with the full document. This report has a special chapter with a brief description of the U.S. Presidential candidates’ positions on key economic policy issues and what they could mean for Latin America and the Caribbean.

Link to the document:

https://www.cepal.org/en/publications/80755-united-states-economic-outlook-first-half-2024

Related content

Subregional headquarter(s) and office(s)

Country(ies)

-

United States