United States economic outlook: 2020 in review and early 2021 developments

Work area(s)

The United States economy contracted at a 3.5% annual rate in 2020; faster growth is expected in 2021.

-

The United States economy contracted 3.5% in 2020, the worst contraction since World War II, but is expected to grow an estimated 6.5% in 2021, the fastest pace in three decades. The projections are supported by a pickup in vaccination rates, which are powering consumer spending and alowing businesses restrictions to be relaxed, and by federal-stimulus funds that have been flowing through the economy in the early months of 2021.

-

The United States economy lost 9.4 million jobs in 2020, and the unemployment rate was at 6.7% at the end of December.

-

The job market now seems to be on its way to recovery, however. In March 2021, 916,000 jobs were added and the unemployment rate fell to 6%. Hiring was stronger in some sectors that had been hit hardest by the pandemic recession.

-

While almost 1 million jobs were created in March 2021, the number of unemployed 27 weeks or longer increased to 4.2 million from 4.1 million in February, according to the U.S. Bureau of Labor Statistics. One year after the pandemic started, there are still 8.4 million fewer jobs in the United States economy.

-

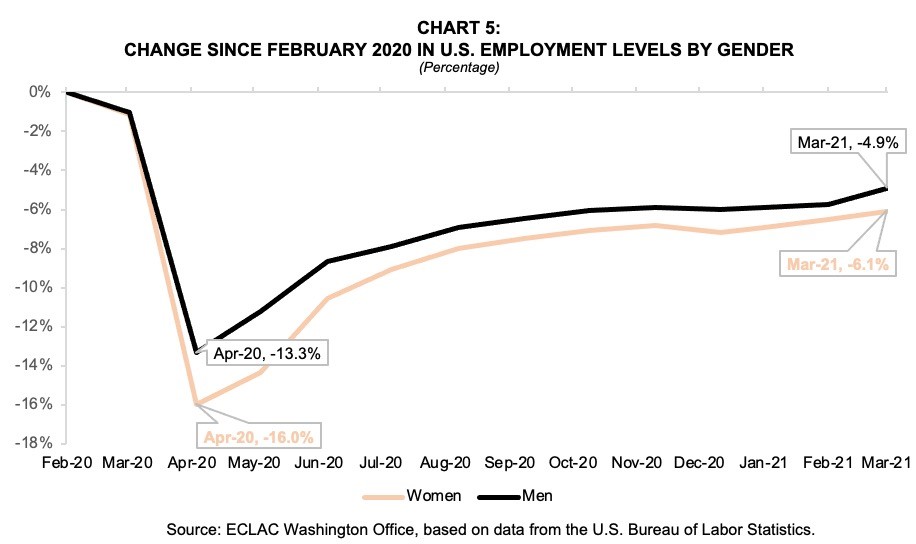

While more than 2 million women in the United States left the workforce over the last year, driven out by the disproportionate impact of pandemic restrictions on female-dominated industries and the lack of school and adequate child-care options, 492,000 women reentered the workforce in March 2021, as schools began to reopen for in-person learning. However, women’s employment losses since February 2020 were still higher than losses for men in March 2021.

- The improved market liquidity created by the U.S. Federal Reserve benefitted Latin American and Caribbean sovereign and corporate borrowers, who in 2020 placed the region’s second highest annual debt issuance on record in international markets. However, a powerful recovery in the United States in 2021 and beyond may pose risks for the region’s issuers when it comes time to refinance longer-term debt, as they may face steeper interest rates for dollar borrowing.

For a complete and detailed analysis see the PDF attachment with the full document.

Subregional headquarter(s) and office(s)

Country(ies)

-

United States