Trends and major holders of U.S. federal debt in charts

Work area(s)

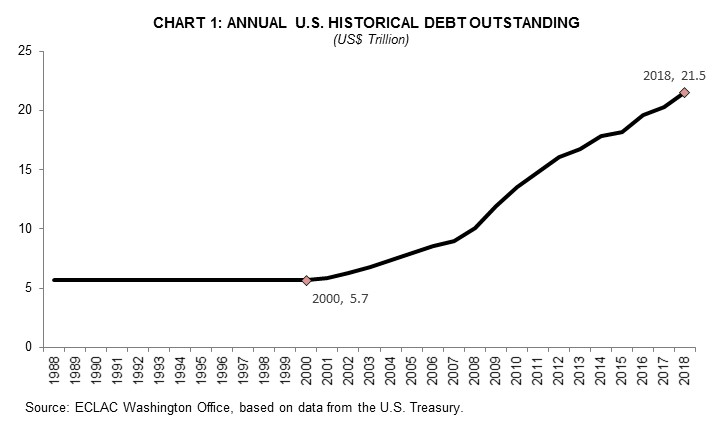

The U.S. debt burden became heavier as a result of the unprecedented policy response to the global financial crisis and economic recession, and it has continued to grow.

- Federal debt has increased and its pace has accelerated since 2001

At the end of the fiscal year in September 2018, U.S. debt was at US$ 21.5 trillion. In February 2019, federal debt reached a milestone, surpassing US$ 22 trillion.

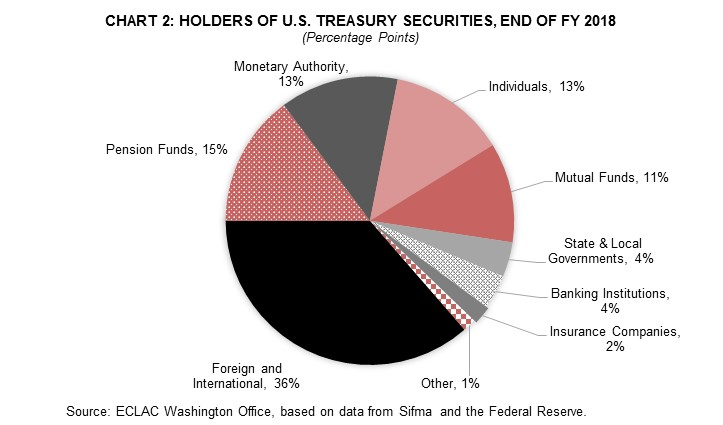

- Foreign and international entities hold the largest share of U.S. debt

As of end of FY 2018, 36% of the U.S. Treasury securities held by the public were owned by foreign and international entities, a decline from the peak of 45% reached in 2008. Pension funds and the monetary authority (the Federal Reserve) are the second and third largest holders, at 15% and 13%, respectively.

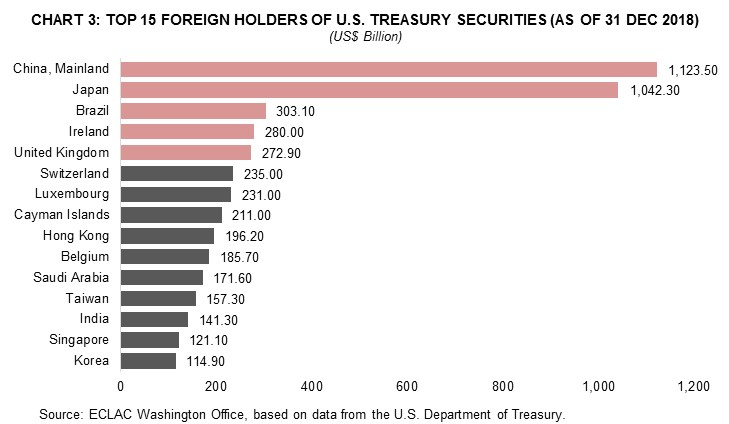

- The top five foreign holders

The five largest foreign holders of U.S. Treasury securities as of December 2018 were China, Japan, Brazil, Ireland, and the United Kingdom. Together they owned close to half of total foreign holdings and 14% of the total U.S. debt. China and Japan combined holdings represented 35% of all foreign holdings of U.S. Treasury securities.

- LAC holders of U.S. debt

At the end of 2018, Latin America and the Caribbean (LAC) held 12.5% (US$ 783 billion) of the total foreign holdings of U.S. Treasury securities. Brazil was the third largest foreign holder overall and the largest in the region. Mexico has historically been a major holder of U.S. debt, but after reaching a peak of US$ 85 billion in 2014, it has reduced holdings to US$ 47 billion at the end of 2018. Other South American countries have gained ground, such as Colombia and Chile.

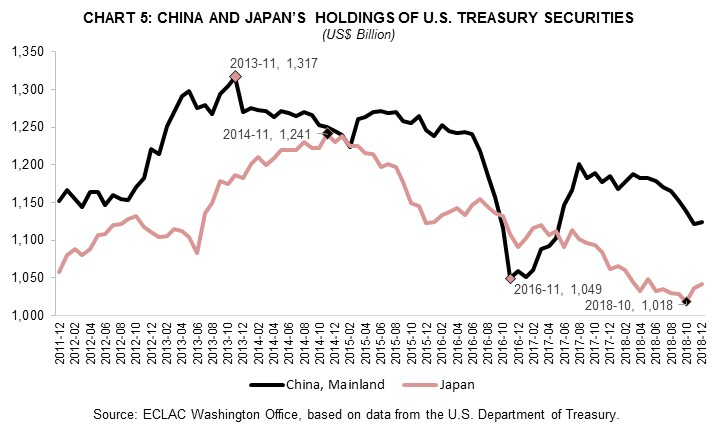

- Foreign demand for U.S. debt has fallen

The foreign share of holders of U.S. Treasury securities has fallen from 43% at the end of FY 2013 to 36% at the end of FY 2018, with China and Japan explaining most of the decline. From December 2013 to December 2018 China’s share of total foreign and international ownership of U.S. Treasury securities fell to 18% from 22%, while Japan’s share fell to 17% from 20%.

For a complete and detailed analysis see the PDF attachment with the full document Trends and major holders of U.S. federal debt in charts.

Subregional headquarter(s) and office(s)

Country(ies)

-

United States