Capital Flows to Latin America and the Caribbean in six charts

Work area(s)

Capital Flows to Latin America and the Caribbean in six charts:

2024 year-in-review and early 2025 developments

In 2024, Latin America and the Caribbean's international bond issuances reached a three-year high.

-

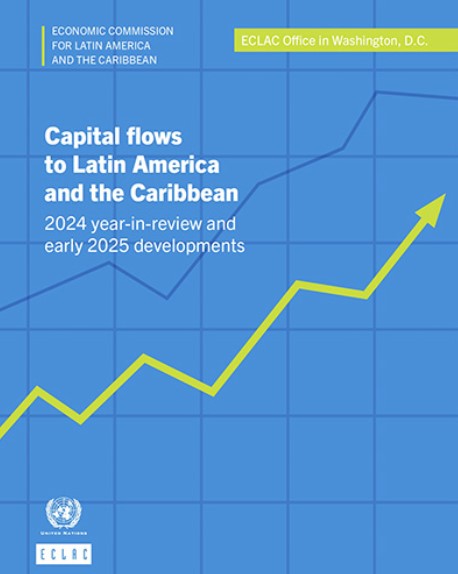

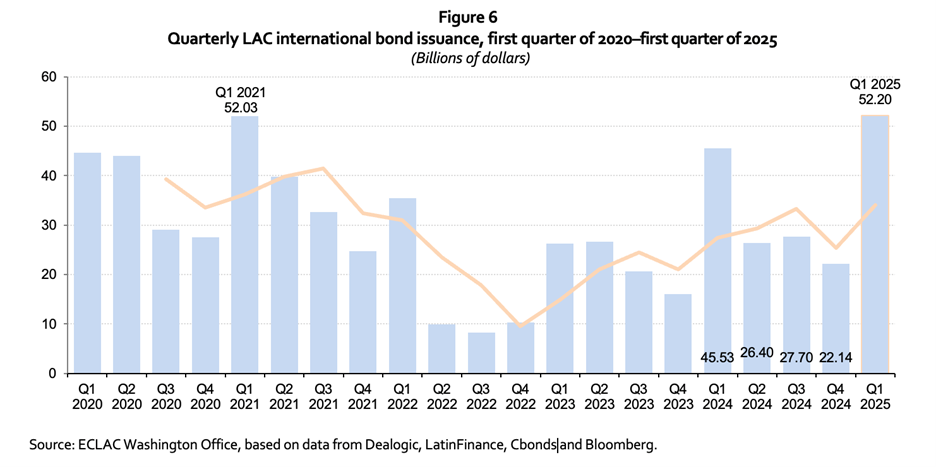

In 2024, cross-border bond issuances by Latin America and Caribbean (LAC) issuers jumped 36% to a three‑year high of US$ 122 billion. Volumes increased as the global monetary policy tightening cycle reached a peak and the United States Federal Reserve lowered interest rates three times —in September, November and December— to a range of 4.25%-4.50% (figure 1).

-

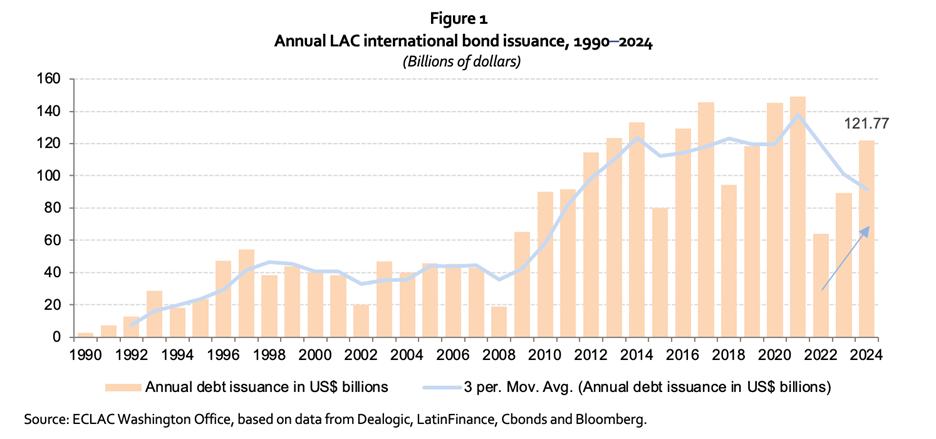

International issuance of green, social, sustainability and sustainability-linked (GSSS) bonds in 2024 was up 6% from 2023 to a total of US$ 33.1 billion. Despite being the highest volume since 2021, GSSS bonds’ participation in the region’s 2024 total was 27%, significantly lower than the record 35% annual share in 2023 (figure 2).

-

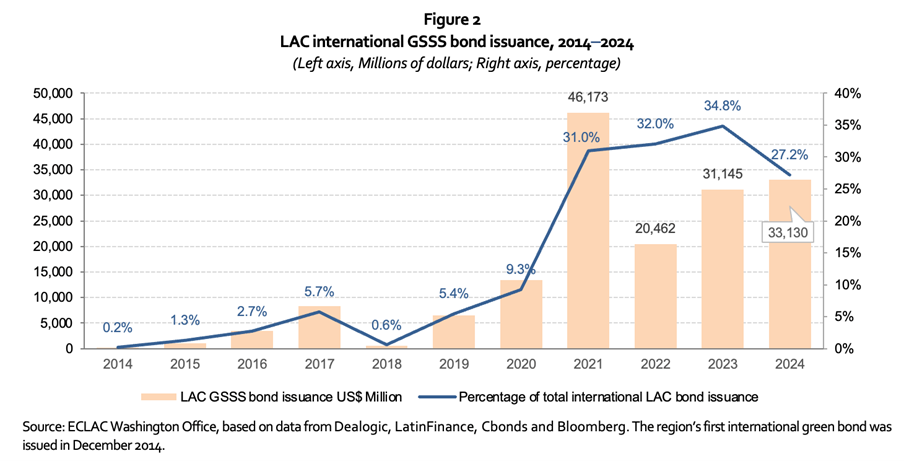

Sovereign credit rating actions in the region were a net positive in 2024, continuing the positive trend that began in 2023. Overall, 37 actions took place, with a balance of 13 more positive credit rating actions than negative. Upgrades outpaced downgrades. There were 13 more upgrades than downgrades in 2024, an improvement over the 2023 annual balance of seven (figure 3).

-

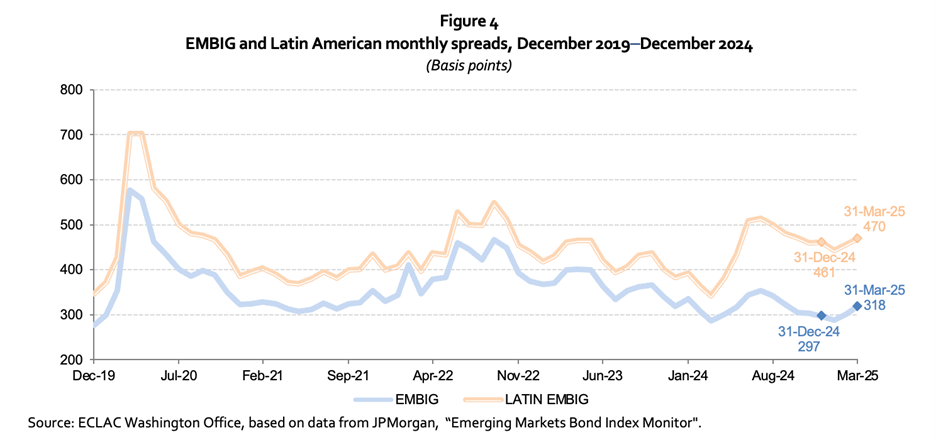

Despite the improvement in credit quality in 2024, borrowing costs for LAC issuers —as measured by the JPMorgan Emerging Markets Bond Index Global (EMBIG) spreads— widened by 78 basis points, while the overall EMBIG tightened by 22. The region’s sensitivity to currency volatility and the strong U.S. dollar may explain why the Latin EMBIG experienced widening spreads while the overall EMBIG did not. In the first quarter of 2025, however, the widening of 9 basis points in LAC spreads was smaller than the 21 basis points increase in the overall EMBIG (figure 4).

-

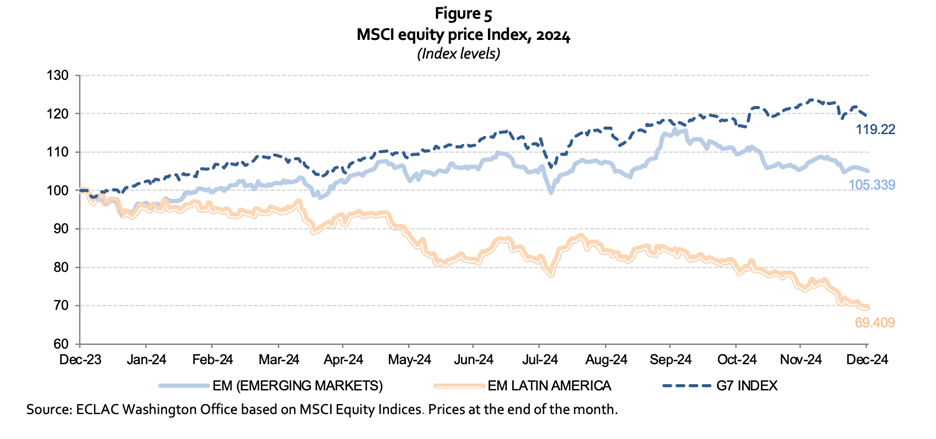

Latin American equities in U.S. dollar terms weakened in 2024 after a robust performance in 2023. The MSCI Latin American index lost 30% in 2024, underperforming the emerging market and G7 indices, which gained 5% and 19%, respectively (figure 5). As in the case of bond spreads, the MSCI Latin American index performed better in the first quarter of 2025, gaining 11% compared to a smaller gain of 2.4% for the emerging market index and a loss of 2.8% for the G7 index.

-

Latin American and Caribbean bond issuers placed international bonds at a rapid pace in the first quarter of 2025 despite increased uncertainty, reaching a quarterly record of US$ 52.2 billion and surpassing the previous peak reached in the first quarter of 2021 (figure 6).

For a complete and detailed analysis see the PDF attachment with the full document.