Capital Flows to Latin America and the Caribbean in five charts: First half of 2023

Work area(s)

Latin American and Caribbean international bond activity ended the first half of 2023 on a strong note.

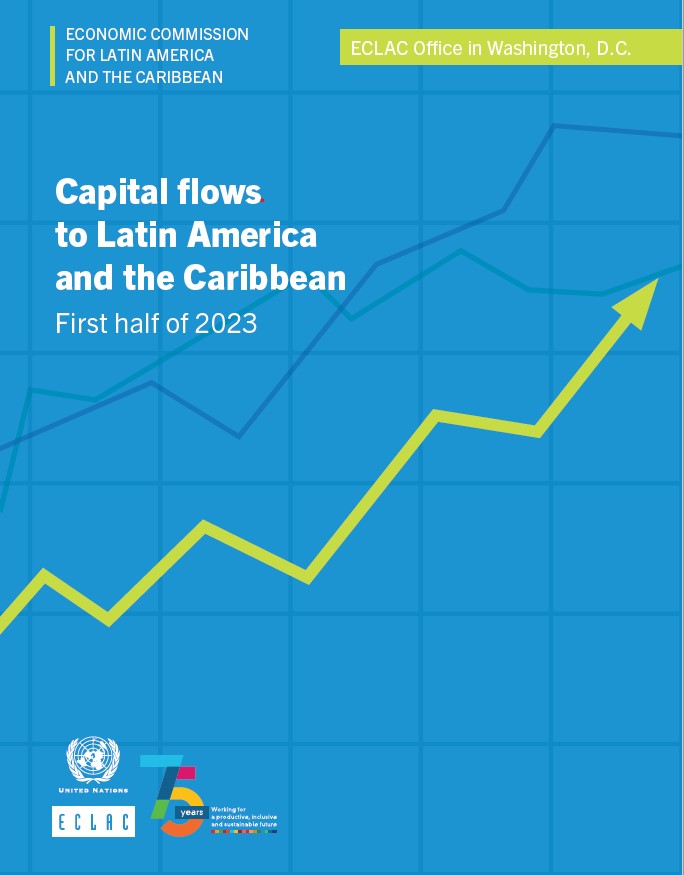

1. Latin American and Caribbean (LAC) bond issuers placed US$ 50 billion in international bond markets in the first half of 2023. This total was 9% higher than in the first half of 2022 and 158% higher than in the second (figure 1).

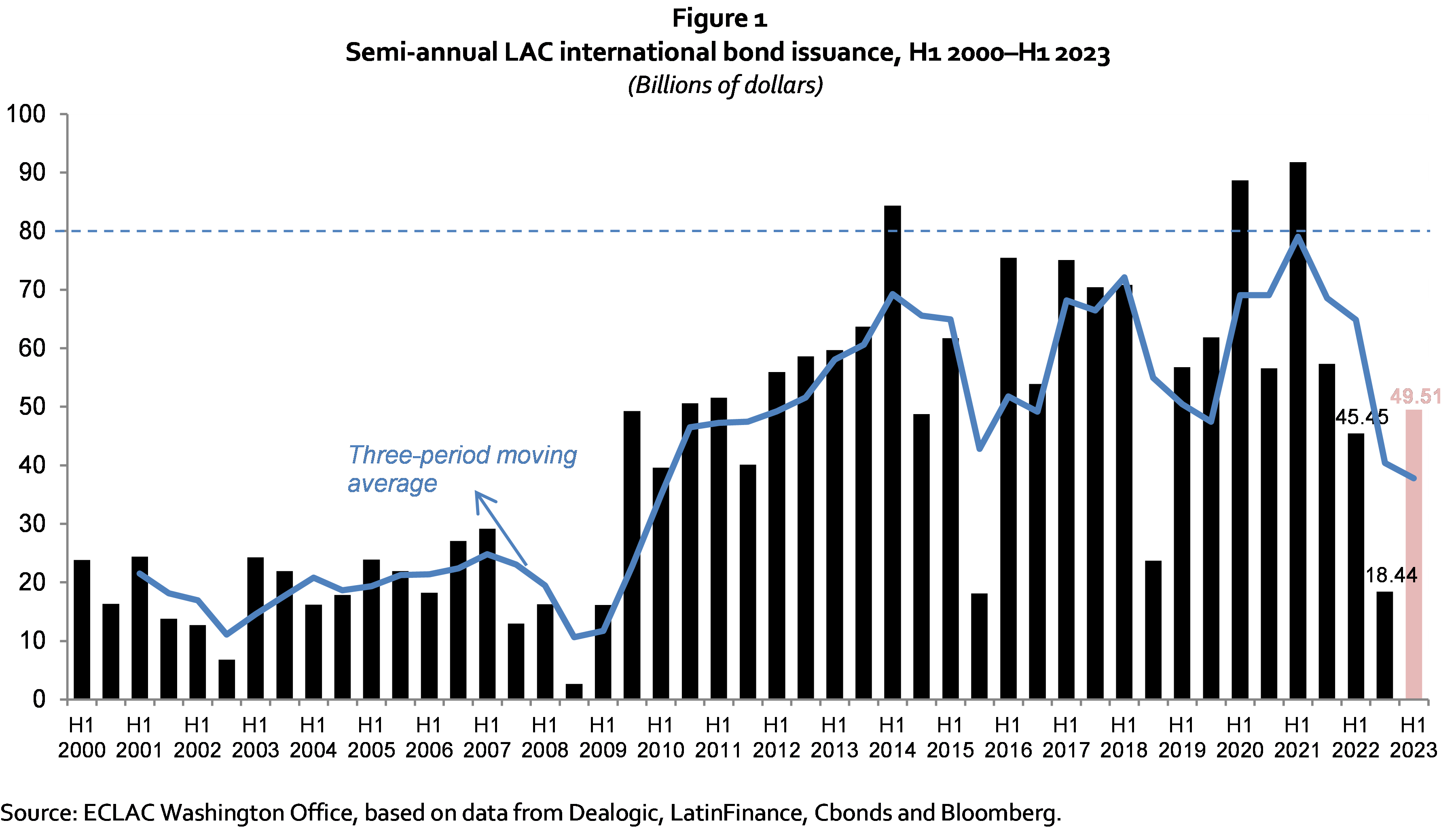

2. On a monthly basis, the highest totals were seen at the beginning and at the end of the semester (figure 2). There was a flurry of new LAC bond issuances in the last two weeks of June, which has continued in July, suggesting a resurgence in the region’s bond market activities after a period of lull.

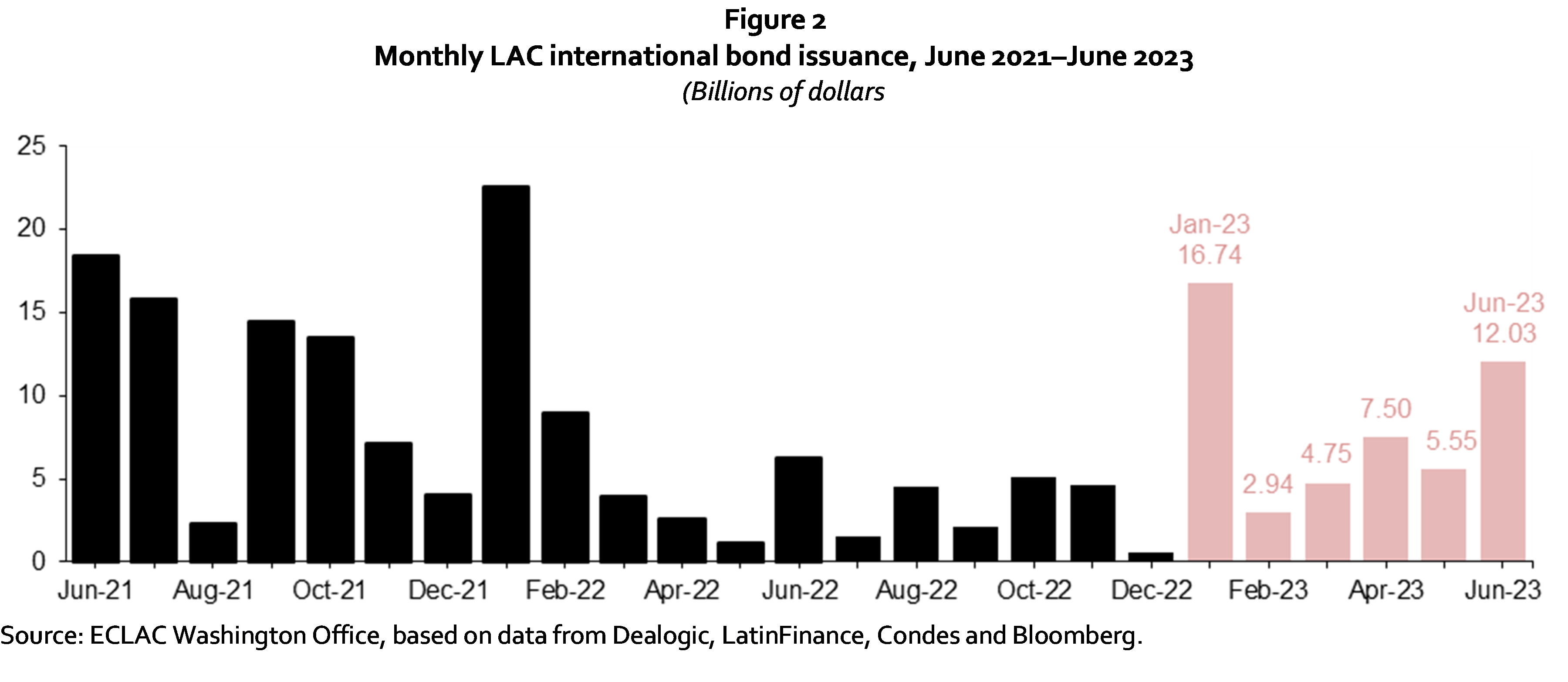

3. The region’s sustainable bond issuances showed resilience in the first half of 2023. Following the broader market trend of a comeback towards the end of the period, 60% of the total sustainable bond issuances took place in May and June. They were up 14% from the first half of 2022 and 180% from the second half. The largest increase in issuances was observed in the sovereign sector (figure 3).

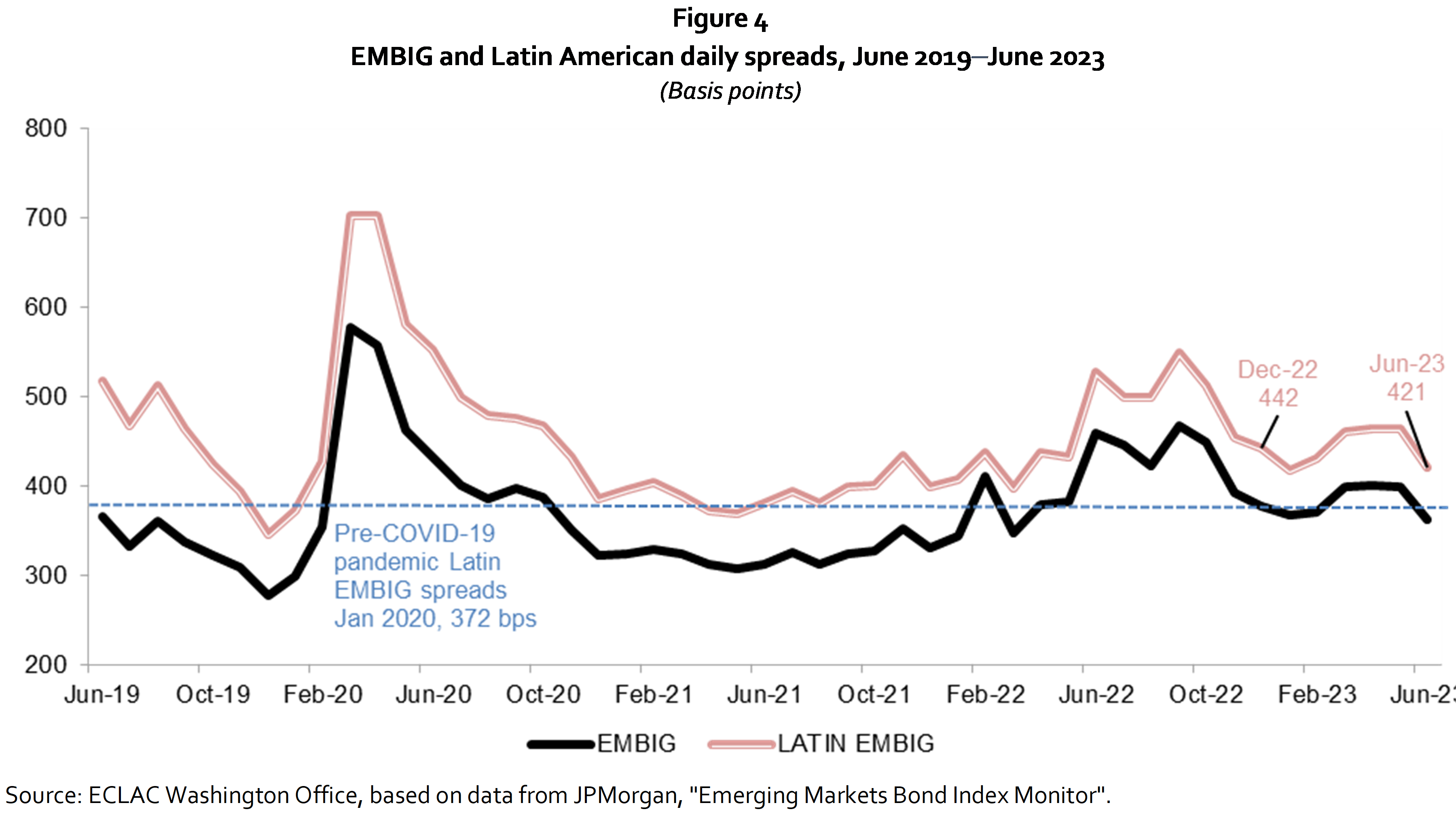

4. Borrowing costs for LAC issuers tightened by 19 basis points in the first half of 2023. While the region’s bond spreads widened in March, they stabilized in April and May as the strains from bank failures subsided and declined in June. The recent decline in spreads is supported by currency appreciation, the region’s progress in the fight against inflation, and expectations that its economies are likely to be the first ones to start easing policy (figure 4).

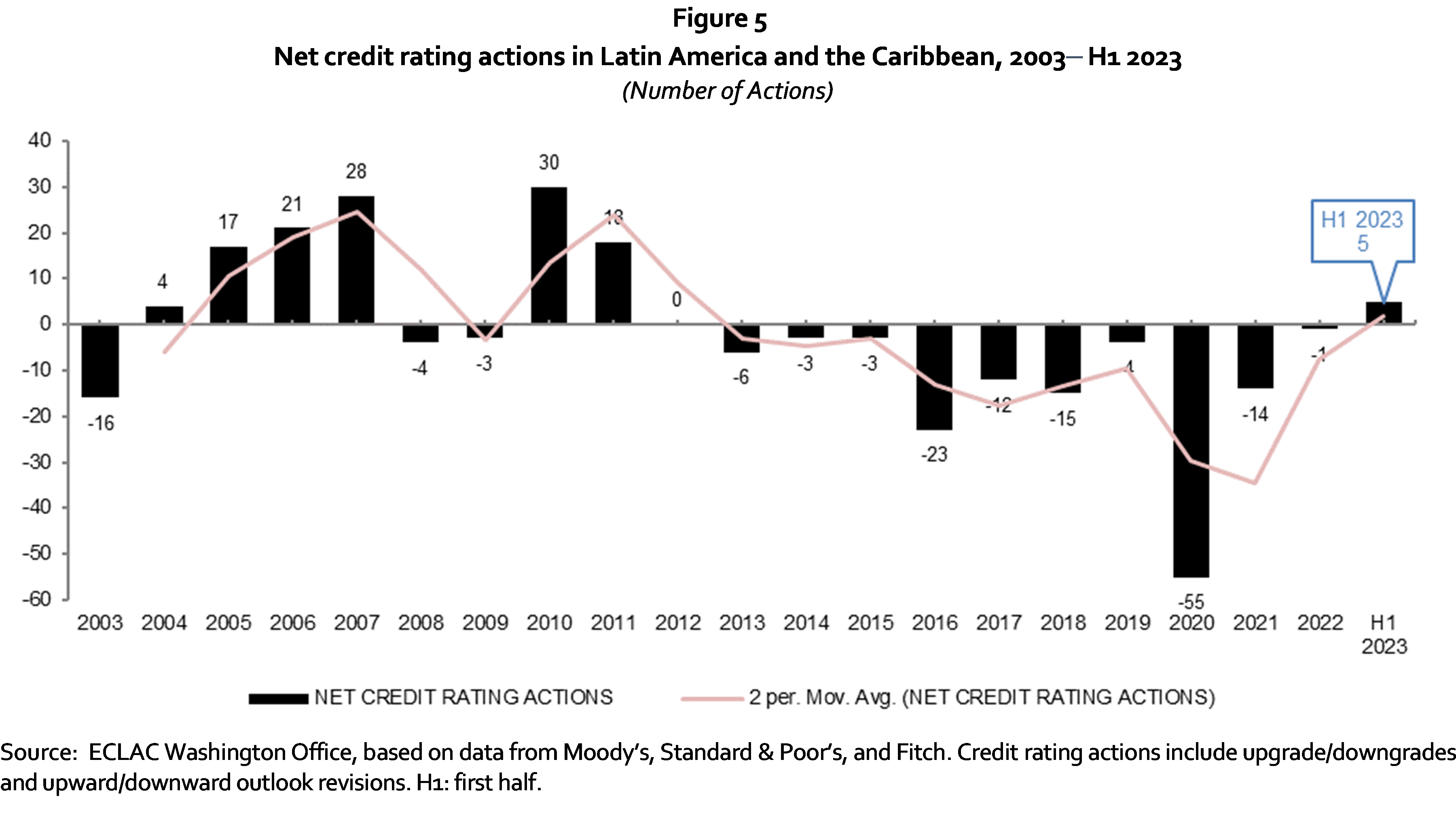

5. The region’s sovereign credit quality improved in the first half of 2023, supported by lower funding needs and greater reliance on local markets. Following ten consecutive years when negative credit rating actions outnumbered positive actions in the region, there were five more positive actions than negative in the first six months of the year (figure 5).

Subregional headquarter(s) and office(s)

Country(ies)

-

United States