Capital Flows to Latin America and the Caribbean First four months of 2021

Work area(s)

Topic(s)

Capital Flows to Latin America and the Caribbean—First four months of 2021

Latin American and Caribbean debt issuers reached a milestone in the first quarter of 2021, registering the highest quarterly issuance on record in international bond markets. In the first four months of 2021, the total reached US$ 65.5 billion.

1. With a backdrop of low global interest rates and borrowing costs, Latin American and Caribbean issuers placed US$ 52 billion worth of bonds in international bond markets in the first quarter of 2021, the region’s highest quarterly issuance on record.

2. Many issuers covered their refinancing needs early in the quarter, on the expectation of rising interest rates. January issuance represented 59% of the quarterly total and was the region’s third highest monthly issuance. At US$ 13.5 billion, April issuance was less than half of January’s issuance, but an improvement from February and March.

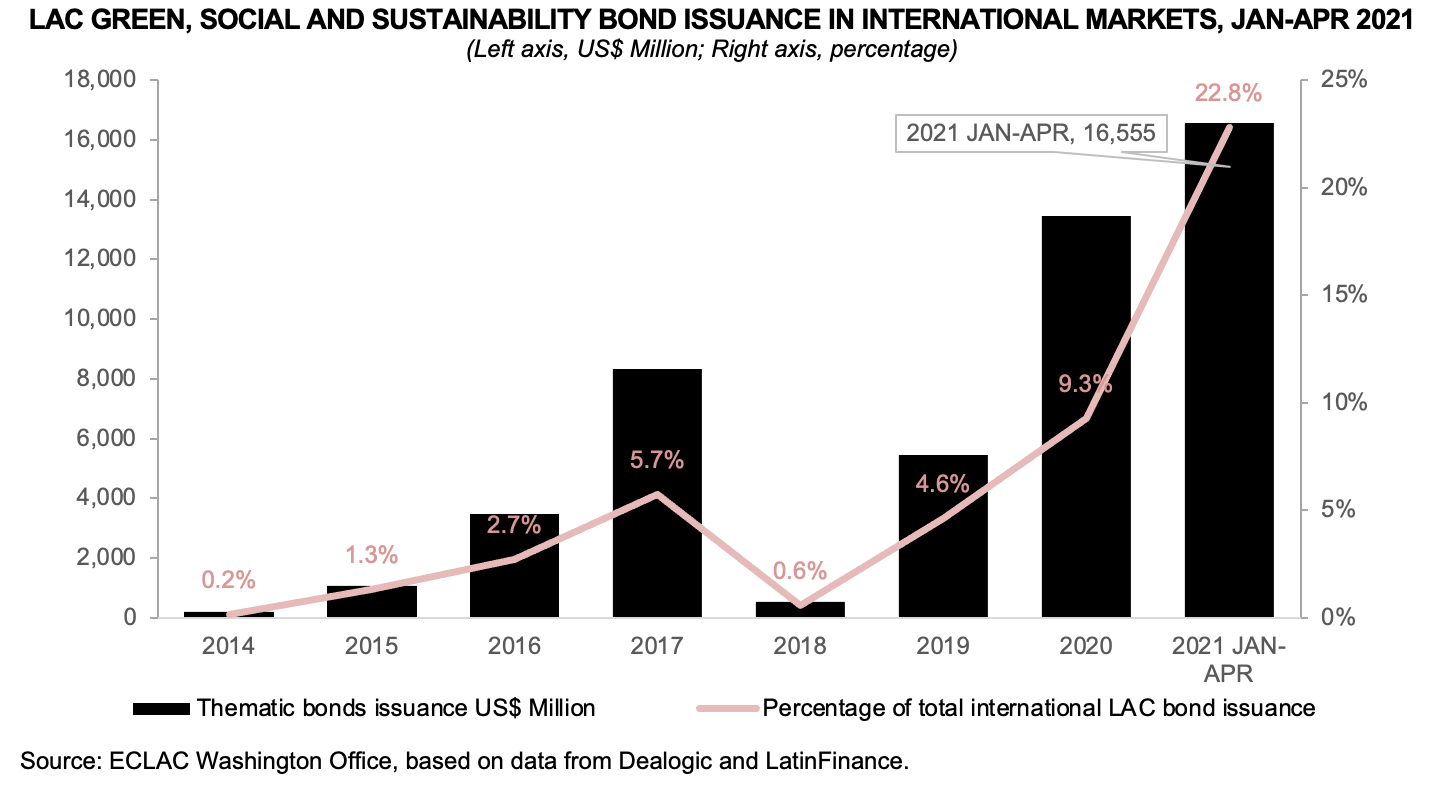

3. The issuance of thematic bonds – green, social, sustainability and sustainability-linked – reached a new record high of US$ 16.6 billion at the end of April, a 23% share of the total amount issued in the first four months of the year.

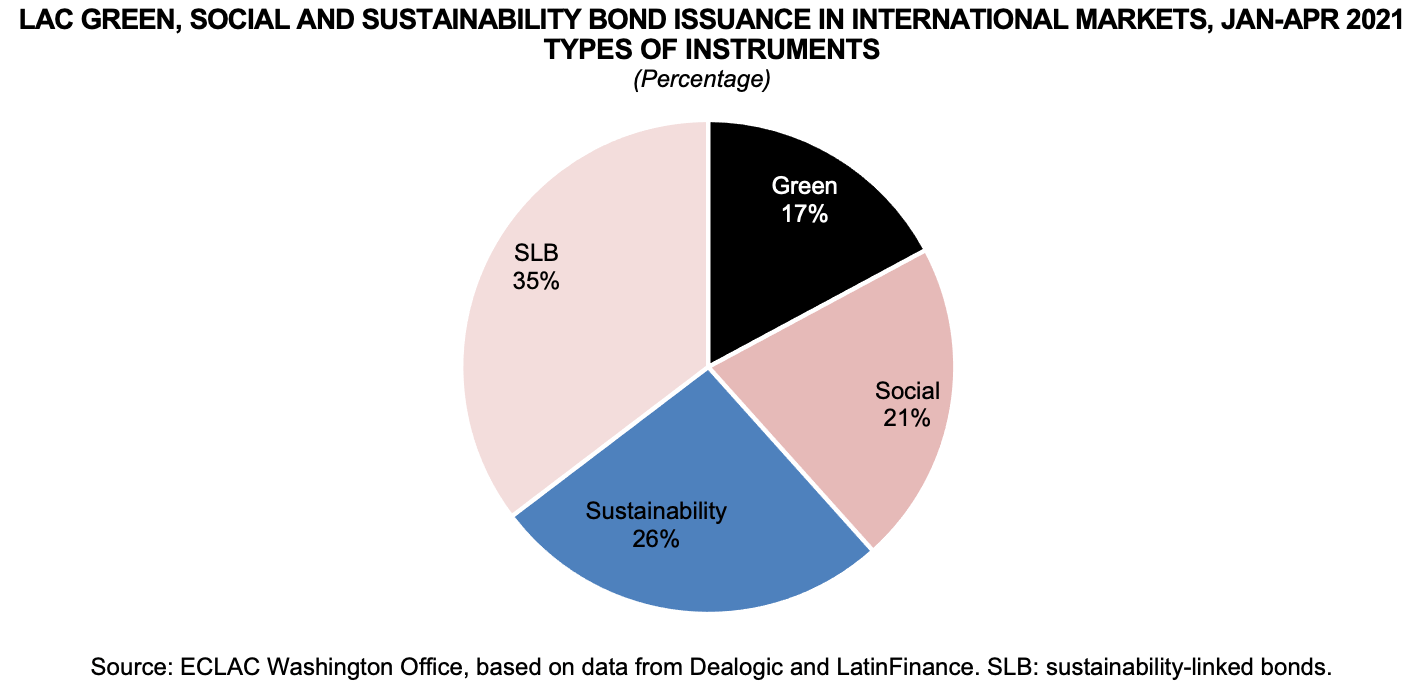

4. Sustainability-linked bonds (SLB) – a forward-looking performance-based instrument – were the most used ESG instruments and accounted for 35% of the total thematic bond issuance.

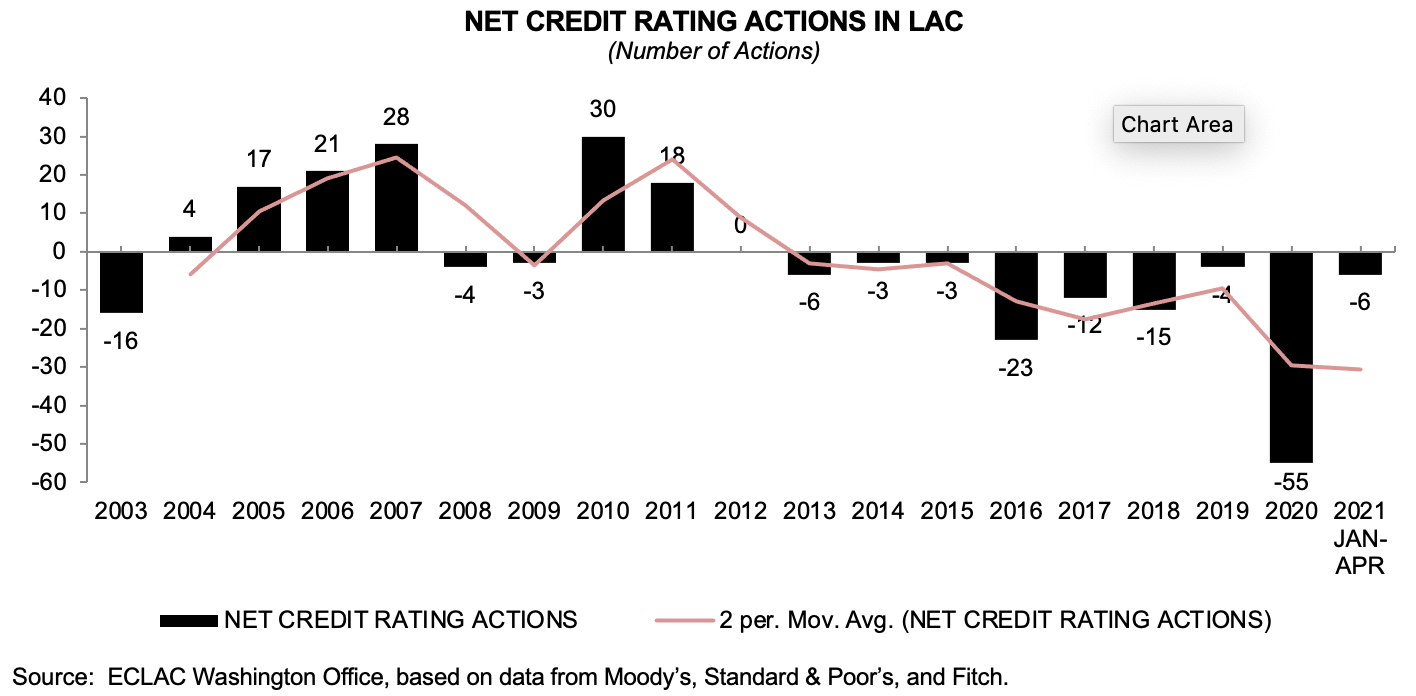

5. Credit quality in the Latin American and Caribbean region continued to deteriorate in the first four months of 2021, with six more negative credit rating actions (including downgrades and downward outlook revisions) than positive in the period. Negative credit rating actions have outnumbered positive actions in the region for eight years in a row, with the imbalance having worsened significantly in 2020.

Subregional headquarter(s) and office(s)

Country(ies)

-

United States