ECLAC Urges the International Community to Work More and Better to Close Global Asymmetries in Financing and Resilience to Climate Change

Work area(s)

During an event at COP26, Alicia Bárcena called for increasing international cooperation on green technologies, capacities and financing to enhance resilience as well as a green transition in the region.

The Executive Secretary of the Economic Commission for Latin America and the Caribbean (ECLAC), Alicia Bárcena, urged the international community today to work more and better to close global asymmetries in financing and resilience to climate change, during a side event at the United Nations Climate Change Conference, COP26, which is taking place in Glasgow, Scotland.

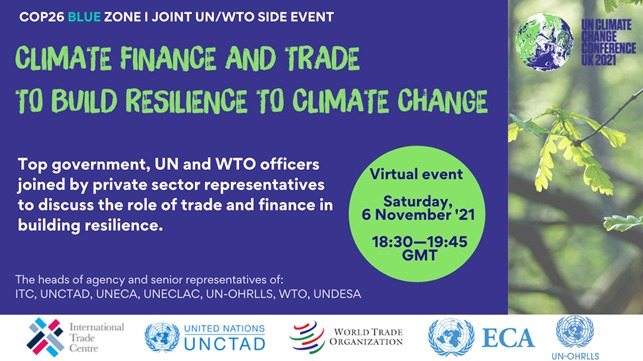

“We welcome recent commitments on curbing methane emissions; halting deforestation; financing cleaner energy infrastructure; and the internalization of climate risks in the operations of financing institutions, including the IMF. However, more needs to be done to close global asymmetries in financing and climate change resilience,” the senior United Nations official stressed at a virtual event entitled “Climate finance and trade to build resilience to climate change.”

ECLAC’s highest authority participated in this event’s opening panel, along with Rebeca Grynspan, Secretary-General of the United Nations Conference on Trade and Development (UNCTAD); Pamela Coke-Hamilton, Executive Director of the International Trade Center (ITC); and Courtenay Rattray, High Representative for the Least Developed Countries, Landlocked Developing Countries and Small Island Developing States (OHRLLS). The panel was moderated by Jean-Paul Adam, Director of Climate Change, Natural Resource Management and Technology at the United Nations Economic Commission for Africa (ECA).

In her remarks, Alicia Bárcena underlined the urgency of redistributing global liquidity to all the vulnerable countries that need it, irrespective of their income level, to enable a climate-resilient recovery. This includes recycling the recently allocated Special Drawing Rights (SDRs) to establish a trust fund that would support middle-income countries, and Small Island Developing States (SIDS) in particular, to finance investment projects for sustainable development.

“We welcome the call by the Prime Minister of Barbados, Mia Mottley, to issue 500 billion dollars in SDRs annually for 20 years, that is, 10 trillion dollars for climate action,” she stated.

She also stressed the importance of reforming the global debt architecture and supporting innovative instruments to improve debt repayment capacity and enhance resilience. This includes debt for climate swaps and the establishment of a Caribbean Resilience Fund, as well as hurricane clauses, which should become a more systematic feature of debt relief initiatives for vulnerable countries, she affirmed.

“ECLAC also proposes the establishment of a multilateral credit rating agency to complement and counterbalance the current oligopoly of private credit rating agencies. Intensifying climate vulnerability emerges as a new cause for downgrades, raising the cost of capital for developing countries when they need it most,” ECLAC’s Executive Secretary underscored.

The senior official further urged for greater international cooperation in order to spend better and more ecologically.

“We must increase funding for adaptation: multilateral funds still channel six times as much to mitigation than adaptation initiatives in Latin America and the Caribbean. Moreover, while carbon pricing is essential for climate action, we are concerned that carbon-related taxes and market access criteria could hamper international trade and create additional asymmetries between developed and developing economies,” she warned.

Finally, Alicia Bárcena emphasized that according to ECLAC’s estimates, only 2.3% of pandemic recovery spending in the region has been channeled into low-carbon projects.

However, she concluded, “rather than restrict market access, we call for increased international cooperation on green technologies, capacities and, of course, financing, to enhance both resilience and the green transition of the economies of Latin America and the Caribbean.”

Related content

COP26 Side Event- Climate Finance and Trade to build resilience to Climate Change

UN ECLAC Excecutive Secretary, Ms. Alicia Bárcena will participate in a COP26 event to discuss the importance of mobilizing climate finance and investment capital through innovative finance…

Type

Country(ies)

- Latin America and the Caribbean