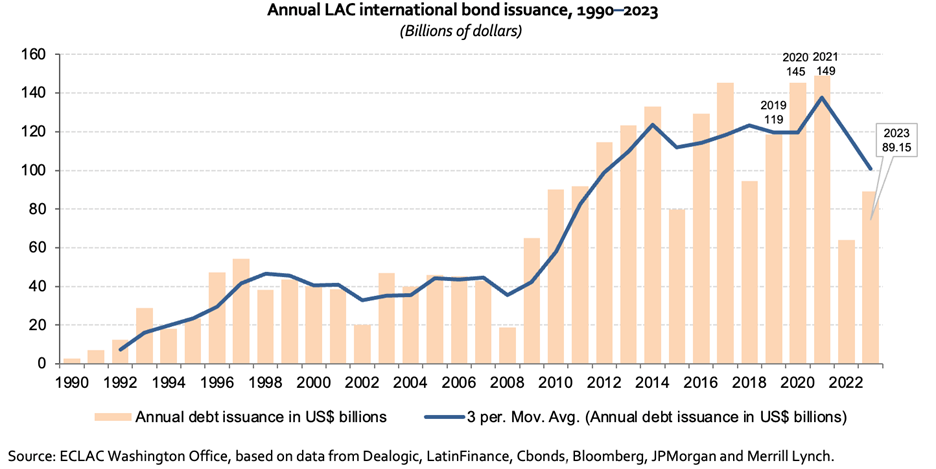

In 2023, Latin American and Caribbean International Bond Activity Rebounded from the 2022 Lows

Work area(s)

The region's issuers placed US$ 89 billion of bonds in international markets in 2023. This total was 40% higher than in 2022 but 35% lower than the average issuance in the three-year period from 2019 to 2021.

Latin American and Caribbean (LAC) issuers placed US$ 89 billion of bonds in international markets in 2023. This total was 40% higher than in 2022 but 35% lower than the average issuance in the three-year period from 2019 to 2021. The average coupon rate was 1.65 percentage points higher than in 2022. This increase has translated into higher financing costs for corporates and for the governments of the region. Average coupon rates on the region’s dollar-denominated sovereign issuances have climbed steadily in recent years, from 3.6% in 2021 to 5.1% in 2022 and to 6.6% in 2023, illustrating how the region’s borrowing costs have increased.

In 2023, with the United States Federal Reserve signaling that its campaign of interest rate increases was reaching a peak, LAC issuers that had been waiting for lower borrowing costs began returning to the international market, anticipating the end of global interest rate hikes, while accepting that rates may remain higher for longer. The largest debt issuance rebound was observed in the quasi-sovereign sector, which showed a year-on-year growth of 109% in 2023. Issuances from supranational entities and national governments grew 42% and 41%, respectively. Bond issuances from the private corporate sector, which had been an important driver of the region’s international debt issuances since 2009 but suffered a decline in 2022 and in the first half of the year, have since started to recover. Private non-bank bond issuances grew 17%, while private bank issuances grew 41%.

The top three issuers in 2023, corporate and sovereign combined, were Brazil, Chile and Mexico, in that order, which together accounted for 57% of the total regional issuance. Brazil was the top issuer, accounting for 21% of LAC annual issuance, followed by Chile (19%) and Mexico (17%). Chile and Mexico were also the region’s top two sovereign issuers, together accounting for 40% of all sovereign LAC debt issuances.

The local currency share of the region’s international bond issuances jumped to 19.5% in 2023 from 8% in 2022. As LAC issuers look for innovative ways to raise capital at a time of tight and expensive financing, by selling bonds in local currency they are able to remove currency risk, and in the case of local-currency sustainable bonds, link the interest rate to sustainability goals.

The region’s issuance of international green, social, sustainability and sustainability-linked (GSSS) bonds reached US$ 31 billion in 2023, up 52% from 2022, but with an average coupon that was 2 percentage points higher. This total represented a record 35% share of the region’s total annual issuance in international markets. Sustainability-linked bonds accounted for 36% of the region’s total international GSSS bond issuance and were LAC issuers’ most used sustainable debt instruments in 2023. Sustainability bonds came in second, with a share of 32%.

Finally, LAC international bond issuances are off to a strong start in 2024. In January 2024, seeking to lock in the decline in U.S. Treasury yields that started towards the end of 2023, LAC governments and companies placed the region’s third highest ever monthly amount of debt in international markets (US$ 31 billion).

Capital Flows to Latin America and the Caribbean: 2023 year-in-review and early 2024 developments provides an overview of the region’s international bond issuances, spreads and credit ratings in 2023 and in early 2024. This report presents and analyses the main trends and developments concerning capital flows to the region and is published by ECLAC three times a year.

Related content

Subregional headquarter(s) and office(s)

Type

Country(ies)

-

United States

Related link(s)

Contact

ECLAC Office in Washington

- eclacwash@eclac.org