ECLAC Proposes a Global Fiscal Compact to Achieve the Sustainable Development Goals

Work area(s)

During a side event at the United Nations General Assembly in New York, the Executive Secretary Alicia Bárcena said that the regional organization can support Latin American and Caribbean countries to better measure tax evasion and avoidance.

“A global fiscal compact must be forged that takes responsibility for, among other things, ending abuse by big companies that evade taxes and hide their profits in so-called tax havens. This compact could mobilize significant funds to achieve the 17 Sustainable Development Goals (SDGs) of the 2030 Agenda,” Alicia Bárcena, Executive Secretary of the Economic Commission for Latin America and the Caribbean (ECLAC), said today in New York.

“ECLAC can support the region’s countries to better measure tax evasion and avoidance, which undermine the goal of achieving sustainable economic growth with equality of rights for the population,” the high-level official said during the event “Tax Havens and a Global Agenda for Tax Justice: A Fair Approach,” held on the sidelines of the high-level segment of the 71st session of the United Nations General Assembly.

Bárcena called for addressing the problem of tax havens in a multilateral way, supporting the idea of creating an intergovernmental technical committee on fiscal matters with a global and regional scope under the UN’s auspices. “It is necessary, for example, to clearly define what tax havens are,” the Executive Secretary said during the gathering, organized by the governments of Ecuador and El Salvador jointly with ECLAC and OXFAM.

Other speakers at the event included the Minister of Foreign Affairs and Human Mobility of Ecuador, Guillaume Long; the Executive Director of OXFAM International, Winnie Byanyima; the Director of the Economic and Political Development Concentration in the School of International and Public Affairs of Columbia University (the United States), José Antonio Ocampo; and the Director of the Earth Institute at Columbia University, Jeffrey Sachs. The discussion was moderated by Gina Casar, Executive Director of the Mexican Agency for International Cooperation for Development.

All of them agreed on the need to urgently address these matters, as a moral imperative, and they offered different proposals ranging from creating a Latin American coalition to more effectively influence the global debate, to establishing taxes on accumulated wealth in tax havens.

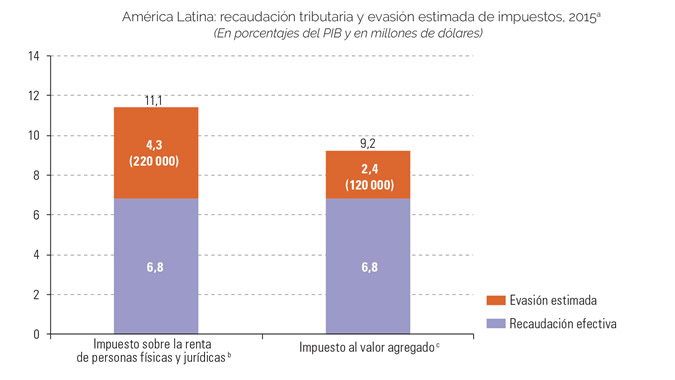

According to ECLAC’s data, tax evasion in Latin America totaled $340 billion dollars in 2015, which represents 6.7% of regional Gross Domestic Product (GDP). Of that percentage, 2.4 percentage points correspond to the Value-Added Tax (VAT) and 4.3 points to income tax.

“Evasion by multinational corporations and high-income individuals erodes our countries’ tax bases,” said Alicia Bárcena, who added that “foreign direct investment is welcome” as long as companies pay what they owe in taxes and the interests of receiving countries are respected.

According to the Economic Survey of Latin America and the Caribbean 2016, released in July by ECLAC, evasion on corporate and personal income taxes exceeds 60% in some countries of the region.

Although at a global level the BEPS (Base Erosion and Profit Shifting) Project led by the Organization for Economic Cooperation and Development (OECD) and the G-20 has made important progress in recent years, ECLAC believes there is still much to be done in this area, Bárcena said, recalling that the richest 10% of people in Latin America and the Caribbean owns 71% of the region’s wealth.

Related content

Tax Evasion in Latin America Totals $340 Billion Dollars and Represents 6.7% of Regional GDP

The main fiscal breaches of compliance correspond to income tax.

Subregional headquarter(s) and office(s)

Country(ies)

- Latin America and the Caribbean

Related project(s)

Contact

Public Information Unit

- prensa@cepal.org

- (56 2) 2210 2040