De-Risking

Work area(s)

Topic(s)

** Please don't hesitate to share with your partners or publishing associates.<br />

*** The infographics and fact sheets may not be altered, transformed, or built upon and you must attribute the work to ECLAC in the manner specified.</p>

Teaser

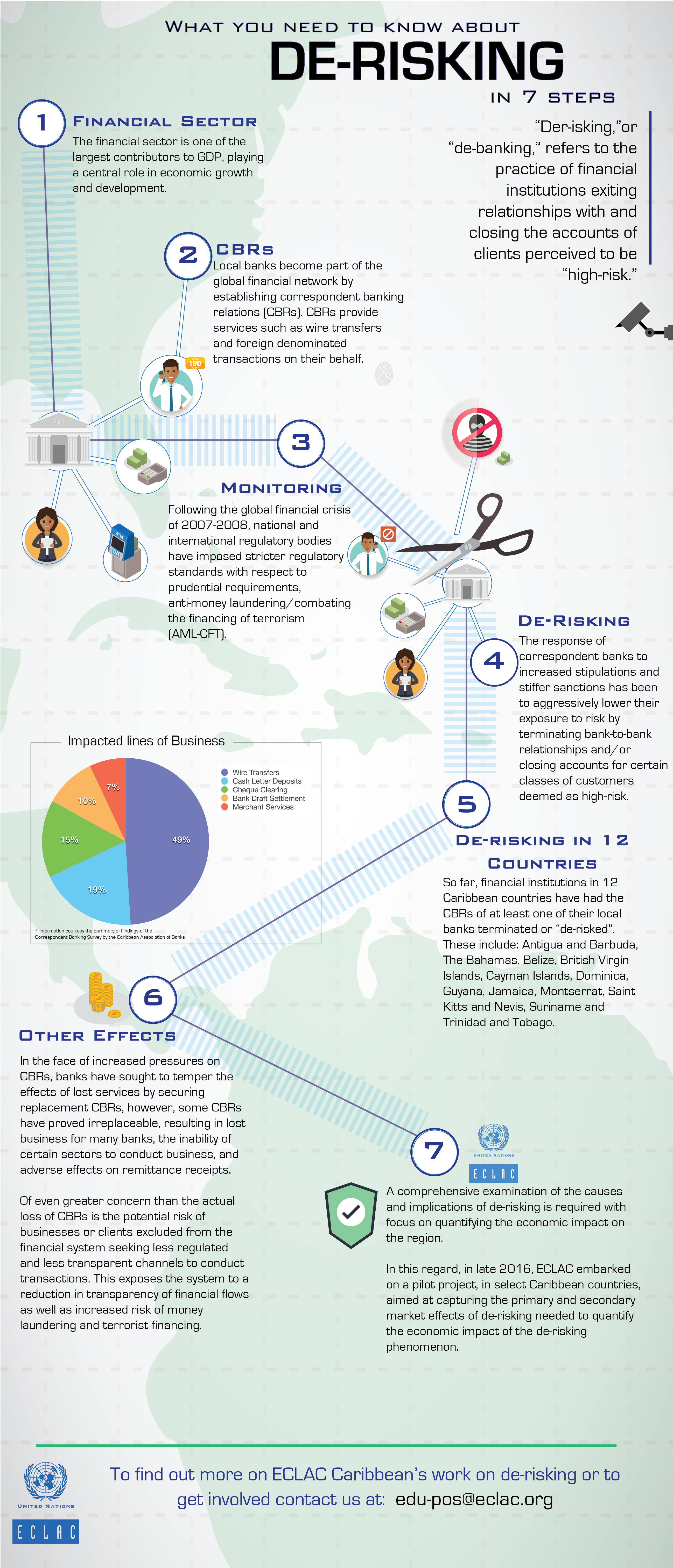

A daunting challenge faced by financial institutions

in the Caribbean in recent years is the growing trend

being adopted by large global banks that serve as

correspondent banks to local financial institutions, to

severely limit or terminate their correspondent banking

relationships (CBRs) with these local or regional banks

(respondent banks). This practice is considered a form

of “de-risking”, whereby business relationships with

clients or categories of clients considered “high-risk”

are restricted or terminated. So far, financial institutions

in 12 Caribbean countries have had the CBRs of at least

one of their local banks terminated or “de-risked”.

Related content

ECLAC report considers the use of blockchain technology to combat de-risking

Recent developments in the field of financial technology (FinTech) may offer potential solutions to some of the problems surrounding de-risking and the navigation of correspondent banking…

Subregional headquarter(s) and office(s)

Related link(s)

Attachment(s)

Country(ies)

- Caribbean