Capital Flows to Latin America and the Caribbean in five charts: first four months of 2024

Work area(s)

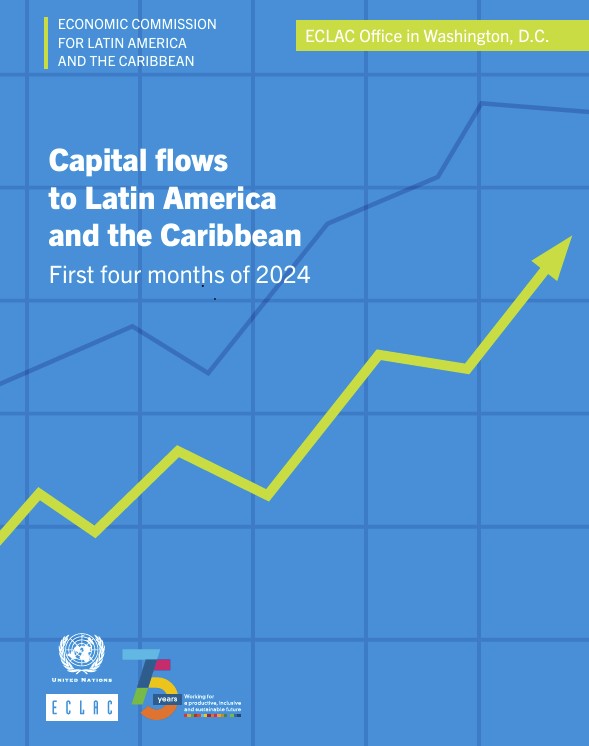

Latin America and the Caribbean's international bond issuance in the first quarter of 2024 was the fifth highest quarterly issuance in the region.

-

Latin American and Caribbean (LAC) issuers placed US$ 53 billion of bonds in international markets in the first four months of 2024. This total was 61.5% higher than in the same period in 2023. Although LAC issuances remained relatively robust in February, they slowed in March, but January strength was enough to guarantee a spot for the first quarter of 2024 in the region’s top five quarterly issuance totals (figure 1).

-

Corporate bond issuances represented 58% of the total, following two consecutive years in which sovereign issuances surpassed the 50% mark. Private bank and non-bank debt issuances showed the largest increase relative to the same period in 2023 (figure 2).

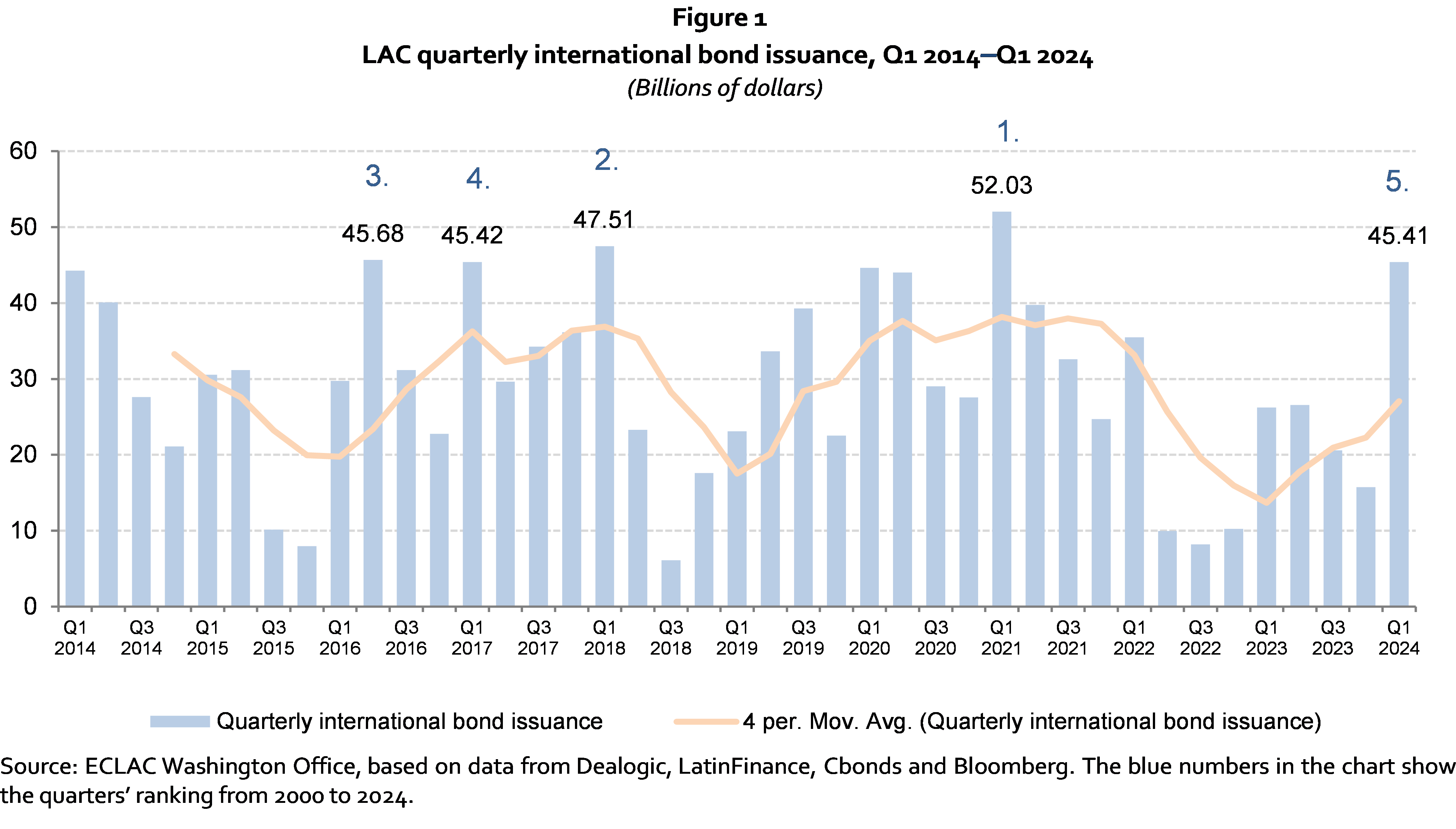

- The region issued US$ 13 billion in international green, social, sustainability and sustainability-linked (GSSS) bonds, up 90% from the same period in 2023. This total represented a 24% share of the region’s total international bond issuance, up from 20% in the same period in 2023, but down from the record 35% annual share in 2023 (figure 3).

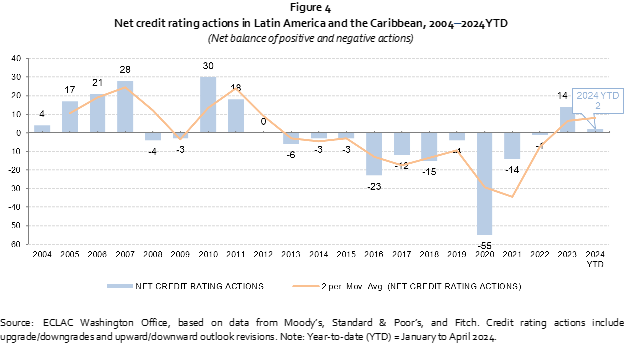

- Credit rating actions in the region over the first four months of 2024 were a net positive. Overall, 12 actions took place, with a balance of 2 more positive credit rating actions than negative (figure 4).

-

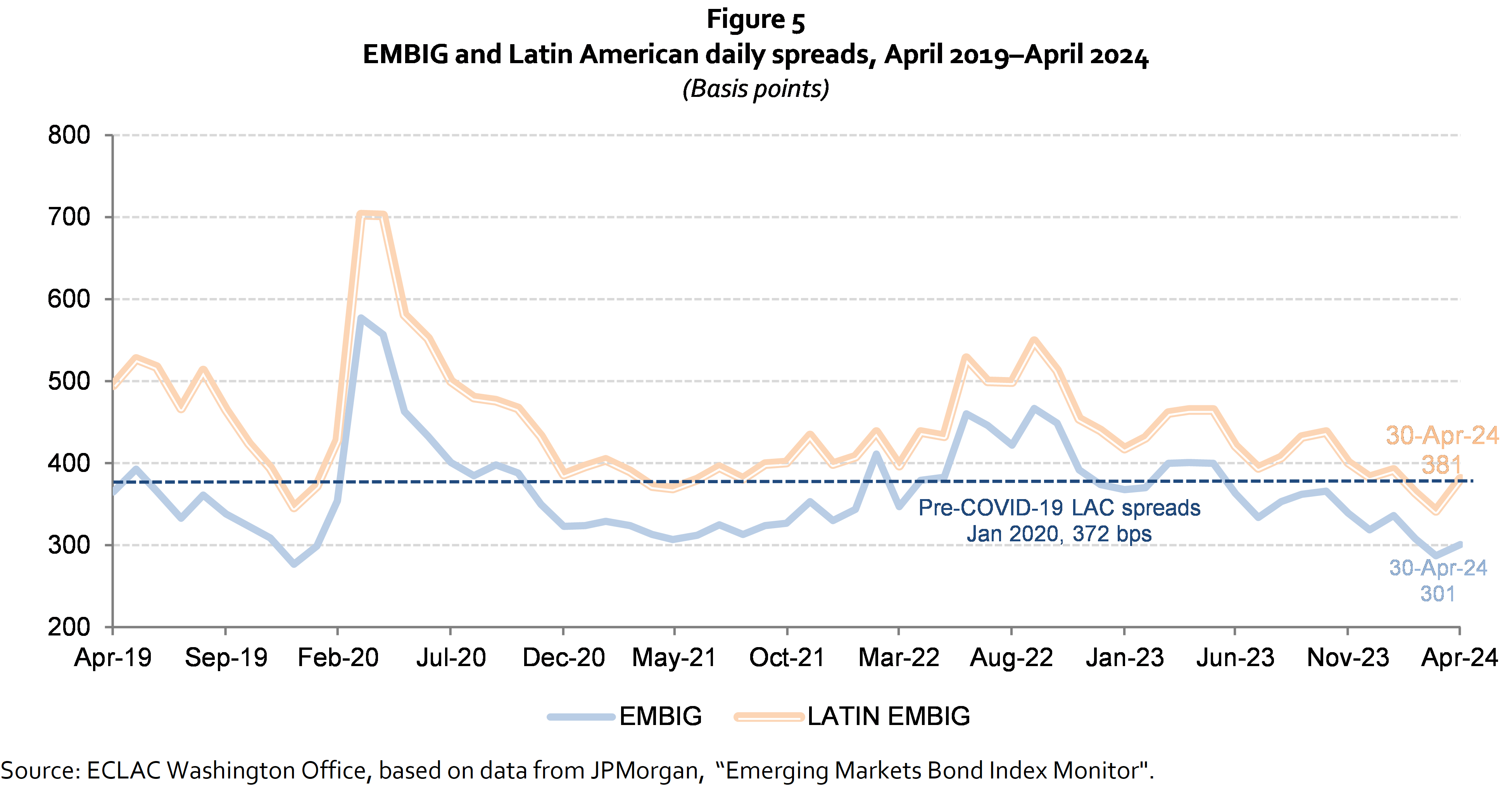

Borrowing costs for LAC issuers as measured by the JPMorgan EMBIG Index tightened by 41 basis points in the first quarter of 2024. They widened in April, however, after a higher-than-expected March U.S. CPI report was followed by a jump in U.S. Treasury yields. LAC bond spreads stood at 381 basis points at the end of April 2024, a tightening of only 2 basis points for the first four months of the year (figure 5).

For a complete and detailed analysis see the PDF attachment with the full document.