Capital Flows to Latin America and the Caribbean—First Nine Months of 2020 in Times of COVID-19

Work area(s)

Global financial conditions have shown signs of stabilization since end of March, due to the action of the major central banks.

-

With a backdrop of low global interest rates and borrowing costs, Latin American and Caribbean (LAC) issuers placed US$ 118 billion worth of bonds from January to September 2020, close to par with the US$ 118.5 billion issued in 2019 as a whole. While LAC issuance in the first and second quarters were the fourth and sixth higher quarterly issuances on record, in the third quarter there was a slowdown.

-

Sovereign issuers already have a higher issuance volume this year than in 2019 as a whole, as governments seek to meet higher funding needs due to the pandemic. Close to 40% of the sovereign bonds issued in the period explicitly mentioned that the proceeds would be used to fund the response to the COVID-19 pandemic.

-

Green, social and sustainability bond issuance represented a record 8.3% of the total amount issued. In September 2020, Mexico became the first country in the world to issue a sovereign Sustainable Development Goals (SDGs) bond.

-

LAC spreads have widened 130 basis points. They widened 357 basis points in the first quarter but narrowed 151 and 76 basis points in the second and third quarters, respectively, as volatility and risk aversion came down after reaching a historic peak in mid-March.

-

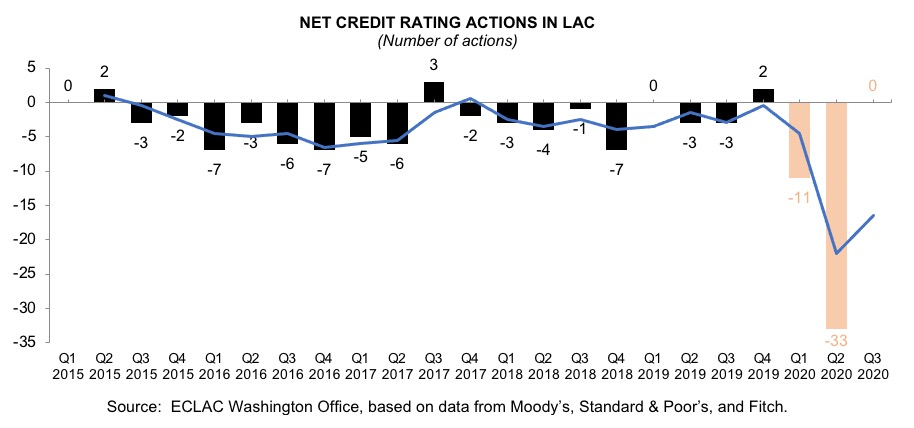

There were 44 more negative credit rating actions than positive in the region and 30 more downgrades than upgrades. The majority of the negative actions took place in the second quarter. In the third quarter, there were seven upgrades due to the successful completion of a bond restructuring or a debt exchange, which included Argentina, Belize, Ecuador and Suriname.

For a complete and detailed analysis see the PDF attachment with the full document.

Subregional headquarter(s) and office(s)

Country(ies)

- Latin America and the Caribbean

-

United States