Announcement

After breaking an annual record in 2021, total Latin American and Caribbean (LAC) bond issuance in international markets slowed considerably in the first four months of 2022.

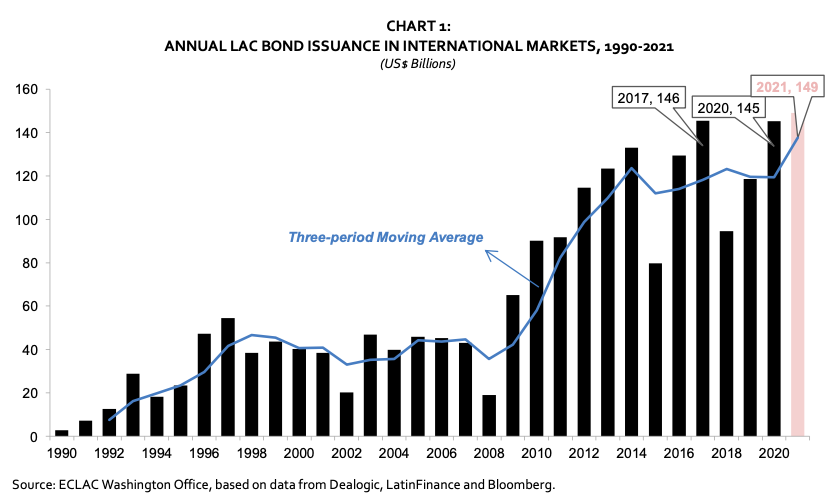

- Total Latin American and Caribbean (LAC) bond issuance in international markets reached US$ 149 billion in 2021, breaking a historical record. In anticipation of tighter external borrowing conditions in 2022, many issuers came to international bond markets to lock-in low global interest rates amid strong demand from investors.

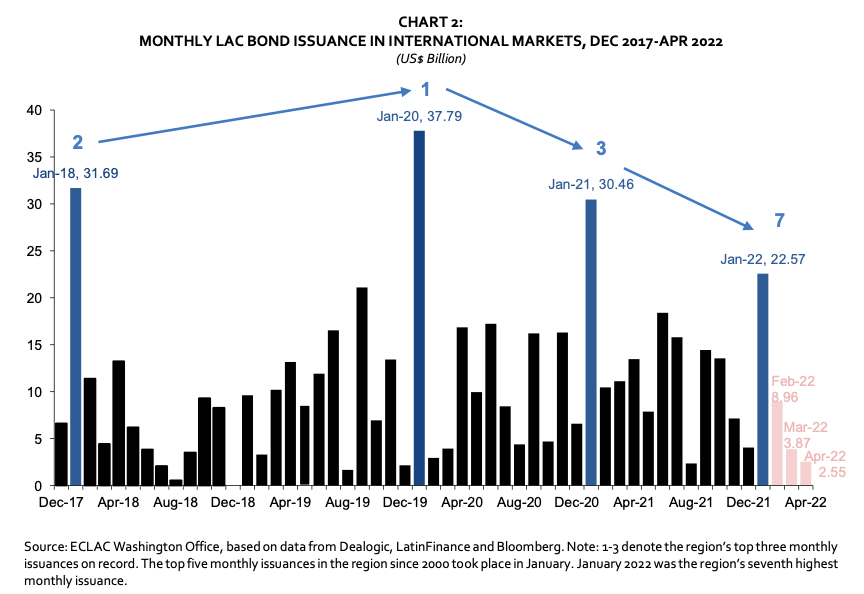

- In the first four months of 2022, LAC international bond issuance slowed relative to the pace of the previous year. At US$ 38 billion, it was down 42% from the same period in 2021, as the United States Federal Reserve’s tightening monetary policy stance and the war in Ukraine contributed to push funding costs higher.

- LAC green, social, sustainability and sustainability-linked bond issuance (GSSS) reached US$ 46.2 billion in 2021, a 31.0% share of the total annual amount issued. This share was more than three times the 2020 share of 9.3%, and almost eight times the 4.2% average of the 2015-2020 period. In the first four months of 2022, this share increased further to 35.4%.

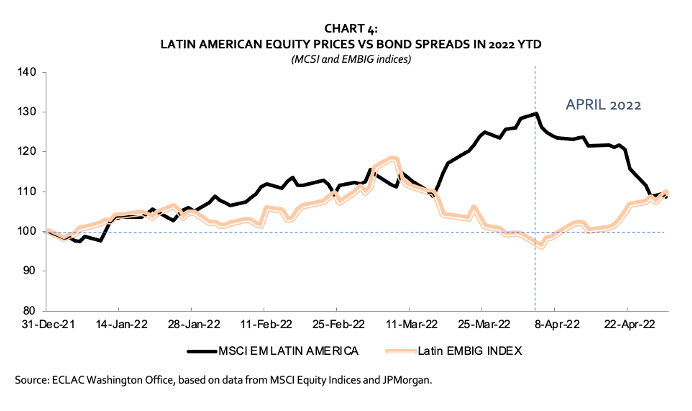

- While bond spreads widened, equity prices declined in the first four months of 2022. LAC bond spreads tightened in the first quarter of 2022 (-2 basis points), only to widen 41 basis points in April, amid rising financing costs and weaker risk sentiment. Equity prices follow a similar pattern, increasing in the first quarter and declining in April.

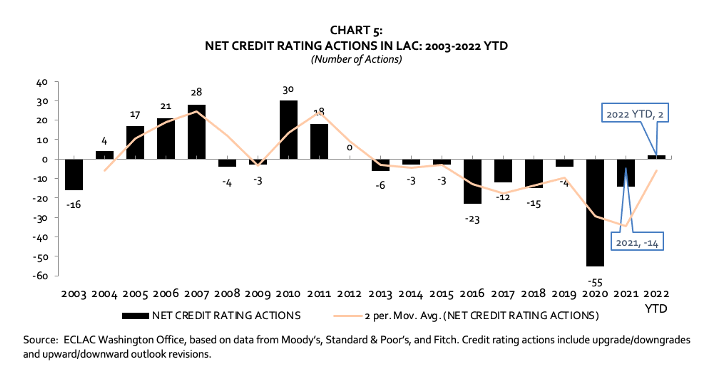

- Credit quality in the region continued to deteriorate in 2021, although at a slower pace than in 2020. There were fourteen more negative credit rating actions than positive in 2021, including fourteen downgrades and no upgrades. Negative credit rating actions have outnumbered positive actions in the region for nine years in a row. Credit quality has shown signs of improvement in 2022, however. As of 4 May 2022, there were two more positive credit rating actions than negative overall since the beginning of the year.

For a complete and detailed analysis see the PDF attachment with the full document.