Background

The concept of financial inclusion encompasses all public and private initiatives to bring financial services to those households and SMEs traditionally excluded from the formal financial sector, and furthermore, to improve and perfect the serviceability of the financial system for the players that are already part of the formal financial circuit.

Inclusiveness – conceived as a productive insertion policy – is a requirement for financial systems to be conducive to sustainable social and economic development. In other words, it implies using the financial system as an instrument for expanding the range of saving and consumption possibilities for the general public, and for improving investment opportunities and harnessing entrepreneurial talents.

Financial innovation can serve as a catalyst for financial inclusion of households and businesses through greater densification of the financial system. Promoting financial inclusion through innovation requires clear and articulate public and private agendas in terms of development objectives and priorities. Accordingly, the presence of development banks should be strengthened given their key role and capacity to be second-tier banks that also complement the commercial activities of private banks.

- Financial inclusion in Latin America and the Caribbean: Context and Stylized facts

- ECLAC Project for promoting financial inclusion of SMEs

Financial inclusion in Latin America and the Caribbean: Context and Stylized facts

Financial inclusion in Latin America and the Caribbean is a prerequisite for sustainable development

Over the past three decades, the financial sector has increased dramatically in advanced and developing countries alike, resulting in more employment, higher salaries in the financial sector compared with the rest of the economy, and an increased volume of financial assets. The sector also saw a rise in its share of overall GDP and grew at a faster rate than the economy as a whole.

Nevertheless, the heightened importance of the financial sector and its greater depth do not guarantee either greater financial development or financial inclusion. ECLAC’s vision of financial inclusion emphasizes the productive aspect of financial inclusion both at an individual and enterprise level. With this understanding, financial inclusion is seen as a policy for productive insertion.

On the one hand, it encompasses all the efforts and initiatives oriented towards providing access to formal financial services to those that lack them. On the other hand, it improves and perfects the use of the financial system for agents, in particular for productive units such as SMEs, which are already part of the formal financial circuit.

The analysis of the state of financial inclusion in Latin America and the Caribbean demonstrates that the region is characterized by:

- a low and unequal access to the formal financial system by households and SMEs; and

- a limited number of instruments and mechanisms for improving financial insertion of productive agents that form part of the formal financial system.

The productive sector also shows low levels of access to the formal financial system by SMEs, and an elevated inequality in terms of levels of access between small and large enterprises. According to the World Bank, current evidence shows that on average just over 45% of small enterprises have access to credit from formal financial institutions in Latin America and the Caribbean. The low level of access corresponding to small enterprises contrasts with that of large companies, 67.8%, in the case of Latin America and the Caribbean. This implies that large enterprises’ access to formal credit is 1.5 times that of small ones.

The financial inclusion gap between small and large enterprises is explained, among other reasons, by information asymmetry and high financial costs. In the case of bank credit, for example, transaction costs for evaluating, processing, and monitoring loans are fixed costs that decrease per unit as the number of loans increases. As a result, it is comparatively more expensive for banks to lend to small enterprises. Likewise, it must be taken into account that the problem of gaps in financial inclusion also corresponds to the inherent characteristics of the financial system in Latin America, which has low levels of financial depth and development, is more short-term oriented, and lacks a variety of financial instruments.

When firms’ access to external financing is limited, their productive capacity and ability to grow and prosper is also restricted; they must operate relying solely on their own funds. Additionally, evidence shows that SMEs utilize the financial system mainly for keeping deposits and transacting payments, while the use of credit products is significantly underrepresented, which could restrict SMEs’ capacity to expand and grow in the future.

This context creates the space for a vicious cycle that keeps productive units small and in a constant state of vulnerability and low growth, with immense consequences that translate into poverty and social inequality.

Development of a sophisticated and inclusive financial system is fundamental to channel investment and savings into sustainable development production methods, technologies, and environmental initiatives by productive agents such as SMEs. Likewise, increased regional productivity is also necessary to boost sustainable growth and development, and this is where the role of SMEs is essential. SMEs (not including micro enterprises) provide roughly one third of the region’s employment and thus have the potential to act as catalysts to increase regional productivity. Inclusiveness also refers to improvements in the usage of the financial system of those that already belong to the formal financial circuit. Under this logic, inclusiveness is a productive insertion policy, enabling the financial system to respond to firms’ many different financial needs and, specially, the needs of SMEs in their different stages of the productive and technologic process. Increased access to tailored business products and services by these firms will broaden their productive capacity and ability to grow.

Financial inclusion in Latin America and the Caribbean: stylized facts

Use of financial services by SMEs

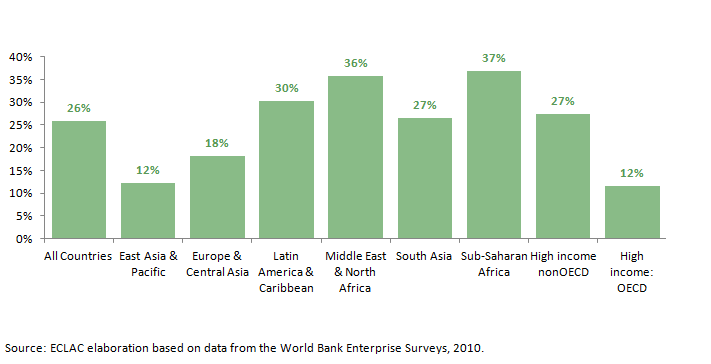

Currently, 30% of the region’s businesses identify access to finance as a major constraint in comparison to only 12% in the high income OECD countries.

Firms identifying access to finance as a major constraint (%)

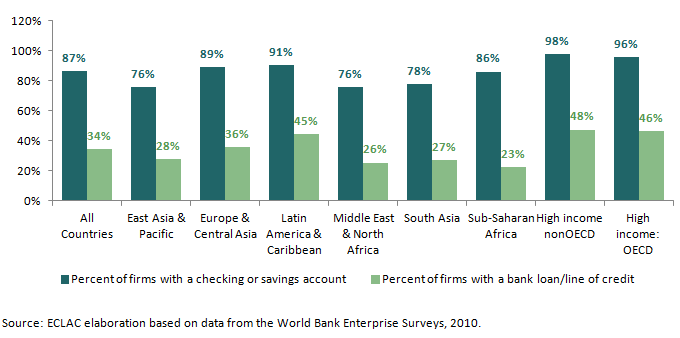

In 2010, 91% of the businesses in Latin America were able to obtain basic checking and savings accounts, while only 45% had a loan or line of credit. While this percent is on par with that of high income OECD countries, the constraint becomes most apparent in the proportion of loans requiring collateral and the value of the requested collateral.

Firms with a bank account in comparison to firms with a loan or line of credit (%)

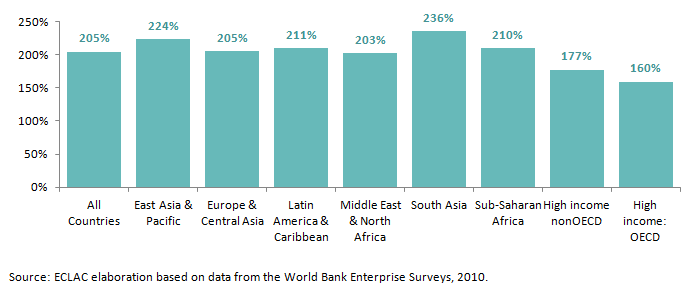

Some of the current hindrances for SMEs to obtain external credit are the high agency costs associated with their high production costs, risk level and lack of credit history. As a result, banks request high levels of collateral and guarantees, which in addition to being some of the highest in the world also vary a lot with the economic cycle (Economic Survey for Latin America and the Caribbean, ECLAC, 2016, p173).

Value of collateral needed for a loan (% of the loan amount)

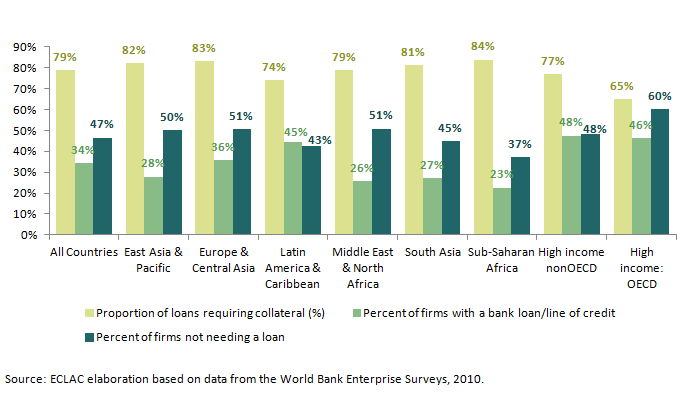

Compared to high income countries, a smaller percentage of Latin American businesses identified with not needing a loan or line of credit. This implies there is unmet demand for credit.

Proportion of loans requiring a collateral and percent of businesses not needing credit

Financial innovation on the part of development banks could be used as a means to increase financial inclusion of SMEs. Development banks, in collaboration with private banks, could fill in the gaps in the market by tailoring specific products and services appropriate to the productive capacity of SMEs while at the same time mitigating the risks to be assumed by creditors. There is also space for policies aimed at improvements in the current intermediation methods and the design of incentives to encourage long-term investing in productive sectors. In this context, development banks can play a decisive role in creating and establishing mechanisms and instruments by introducing new capacities, competencies and processes to improve efficiency, and in the creation of new financial products/services to satisfy the demand for particular financial services.

Level of financial inclusion in Latin America and the Caribbean and comparison to other regions

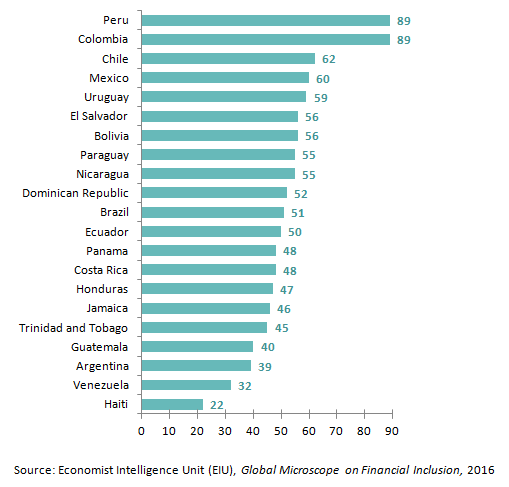

According the Global Microscope, Latin American and Caribbean countries have the following general scores on financial inclusion:

General score on the necessary regulatory environment for financial inclusion (Score / 100)

According to World Bank’s Global Findex, Latin American and Caribbean countries have the following ranks on financial inclusion when it comes to “Accounts and Payments” and “Savings and Credit”:

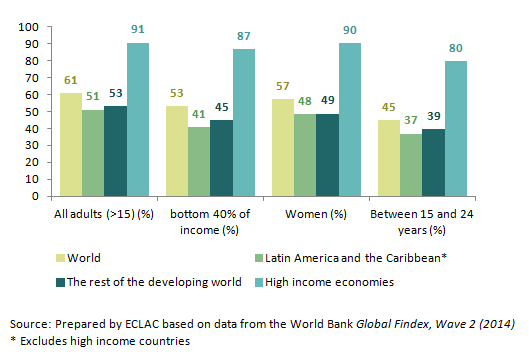

Percent of the population that has an account at a formal financial institution

Latin America and the Caribbean in comparison to the world average

Percent of the population that has an account at a formal financial institution and usage of formal accounts

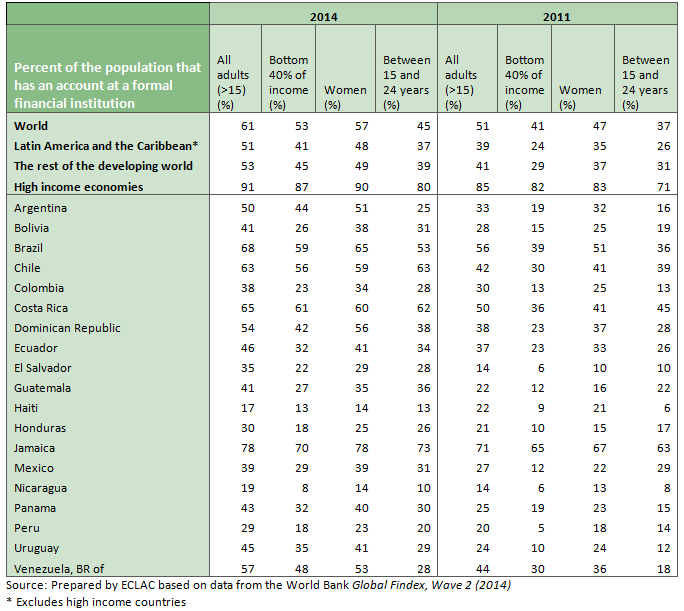

Comparison of countries within Latin America and the Caribbean

Percent of the population that has an account at a formal financial institution: comparison between 2011 and 2014

Comparison of countries within Latin America and the Caribbean

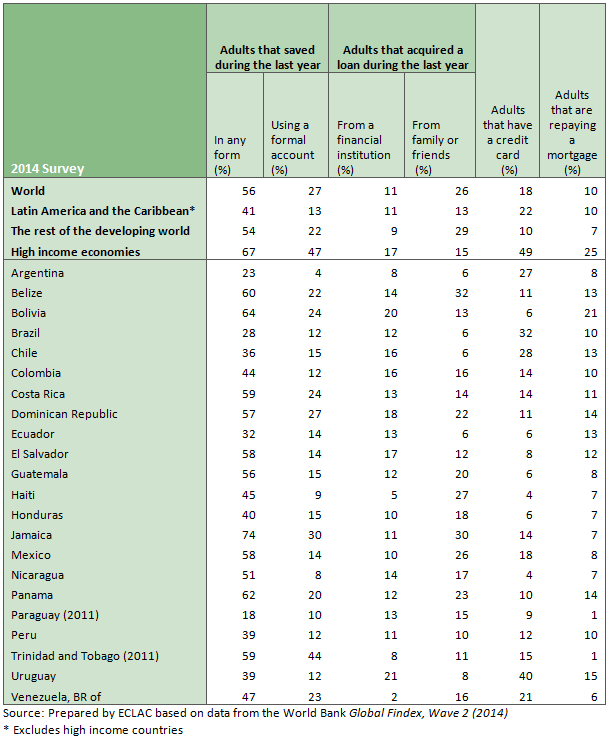

Percent of the population that saved money during the last year and percent that has a loan or credit card

Comparison of countries within Latin America and the Caribbean

ECLAC Project for promoting financial inclusion of SMEs

The aim of the project is to identify and promote the development of a wide set of financial instruments that enable development banks to foster financial inclusion of SMEs, given that these businesses play a central in the productive fabric and job creation. The project focuses on the experience of seven Latin American countries: Argentina, Brazil, Colombia, Costa Rica, Ecuador, Mexico and Peru, with the goal to identify best practices that can be used as an example for other cases and that allow the formulation of policy recommendations for strengthening the role of development banks. In addition, for comparison purposes the project also analyzes the experience of selected East Asian countries.

As part of the project activities, ECLAC is conducting national studies on financial inclusion in seven selected countries. The studies aim to provide an assessment of the state of financial inclusion of SMEs through indicators that measure the basic aspects of financial inclusion. These indicators include Access (ability to use services and products through the formal financial system), Usage (frequency of use of these products and services), and Quality (evaluations based on available data from surveys). The studies also seek to identify, describe, and analyze the instruments and processes that development banks have put in place to promote financial inclusion of SMEs, providing quantitative evidence on the use and reach of the analyzed instruments, as well as an evaluation of their effectiveness. Additionally, the studies evaluate the state of complementarily between national, and regional and sub-regional development banks for improving financial inclusion of SMEs. Finally, the studies provide policy recommendations to strengthen the capacity of development banks to foster financial inclusion of SMEs. Subsequently, the national studies will be complemented with a regional study that will encompass the results of the first studies.

The studies are presented and analyzed at national technical workshops organized by ECLAC. These workshops are aimed at inviting specialized regional entities to give them the opportunity to demonstrate and present their experiences with different financial policies and instruments that promote financial inclusion of SMEs. A special emphasis is placed on identifying the role of the development banks in promoting financial inclusion and how they can correct market failures with innovative new instruments and policies. Through these expert reunions, discussions, and sharing of ideas ECLAC intends to identify the best paths for financial inclusion in the Latin American and Caribbean region while keeping in mind country-specific challenges.

Presentation materials from these events are available for download on the associated events pages. Likewise, the completed studies are published by ECLAC and are available for download.

Expected results

The expected results include:

- The strengthening of public financial policies to promote financial inclusion of SMEs;

- Improvements of development banks’ financial instruments to mobilize resources for productive development;

- Dissemination of information.